TheBRRR’s Thoughts

Editor’s note: the podcast is back! We generate a full conversation between two AIs covering the day’s most interesting stories. Subscribe on Spotify and Apple to get notifications when a new episode drops.

GM.

Since our last update focused on DeepSeek’s breakthrough LLM, Donald Trump and Jay Powell have been the primary sources of market-moving news.

Powell, the long-tenured Fed chair, answered questions at last week’s FOMC following the committee’s decision to leave interest rates unchanged.

He confirmed that inflation progress has been slow and steady, but that they needed continued progress in order to reduce rates from 4.5%, a level he considers restrictive to economic growth.

Powell admitted he hasn’t spoken to Trump—a clear signal he’s not in the inner circle. Relatedly, he pivoted away from his negative rhetoric around crypto and instead nearly encouraged banks to get involved in the space. Given Trump’s executive order for the US to establish crypto dominance, this pivot could be Powell extending an olive branch.

There’s credible evidence that the Fed actively undermined the crypto industry in recent years by exerting soft pressure on banks to limit their availability and breadth of services to crypto companies. Here’s a story covering one of their recent anti-crypto banking actions.

On the Donald Trump front, the new president has had an electric start to his term.

Love him or hate him, he’s speed-running his agenda.

Notably, Trump rocked markets by announcing hefty tariffs on Mexico and Canada because they had refused to address border security. Within hours of the announcement, both countries caved and announced substantial investments in border protection. Trump agreed to 30 day delays as the countries further negotiated on the border.

The dollar pumped on the initial tariff news, then dumped when Trump agreed to delay.

However Trump also announced tariffs on China - a tougher country to win concessions from. China announced tariffs on the US in response, but given the trade imbalance between the two countries, China’s tariffs are much less damaging than the US’ tariffs.

Markets remain uneasy given this tension.

Trump Gets Concessions After Threatening Tariffs

Synopsis:

On February 1, 2025, President Trump signed executive orders imposing a 25% tariff on all imports from Canada and Mexico, with a reduced 10% tariff specifically on Canadian energy exports. Additionally, a 10% tariff was levied on imports from China. These actions were justified under the International Emergency Economic Powers Act, aiming to pressure these countries to address issues related to illegal immigration and the influx of drugs into the United States. Following negotiations, the tariffs on Canada and Mexico have been temporarily paused for 30 days to allow for further discussions, while the tariffs on Chinese goods remain in effect.

The Details:

Tariff Specifications:

Canada and Mexico: A 25% tariff on all imports, with Canadian energy exports (including oil, natural gas, and hydroelectric power) subjected to a 10% tariff.

China: A 10% tariff on all imported goods.

Economic Impact:

Consumer Prices: The Tax Foundation estimates that these tariffs could add approximately $800 in costs per U.S. household in 2025. Specific sectors expected to see price increases include:

Automobiles: Potential price hikes of $2,000 for sedans and $5,000 for SUVs due to increased costs of imported parts.

Housing: Rising costs for building materials like lumber and gypsum, primarily imported from Canada and Mexico, may lead to higher home prices.

Energy: Tariffs on Canadian energy imports could result in increased fuel and electricity prices, especially in the Midwest and New England regions.

Food: Prices for fresh produce and other food items are anticipated to rise due to higher import costs.

International Responses:

Canada and Mexico: Both countries have agreed to bolster border security measures, leading to a 30-day suspension of the imposed tariffs to facilitate further negotiations.

China: In retaliation, China has implemented its own tariffs on American goods and is exploring additional regulatory actions against U.S. companies operating within its borders.

Why It Matters:

These tariffs represent a significant shift in U.S. trade policy and carry substantial economic implications. While intended to address national security concerns, the tariffs are likely to lead to increased costs for U.S. consumers and businesses. The potential for escalating trade tensions raises concerns about broader economic impacts, including inflation and disruptions to global supply chains. As negotiations continue, stakeholders should monitor developments closely to assess the evolving economic landscape.

Crypto Market Shifts: Powell, Sacks, and Regulatory Shakeups Drive Volatility

Synopsis:

The crypto market has been whipsawed by regulatory changes, political shifts, and trade tensions, leading to Bitcoin dropping 6% to ~$98K despite bullish rhetoric from Fed Chair Jerome Powell and White House Crypto Czar David Sacks. Powell’s surprising pro-crypto pivot signaled a shift in the Fed’s stance, while Sacks pushed for regulatory clarity and bank participation in digital assets. Meanwhile, Congress formed a new working group to draft crypto-friendly legislation, and the SEC reassigned its top crypto enforcer, hinting at a softer regulatory environment ahead.

The Details:

📜 Regulatory & Political Moves:

Powell’s Crypto Pivot – The Fed Chair stated that banks "can certainly engage" in crypto as long as they manage risks, a major departure from past hostility. Bitcoin briefly spiked 4% to $105K before retreating.

David Sacks' Press Conference – Trump’s Crypto Czar David Sacks announced a bipartisan congressional task force to establish a clear framework for crypto regulation. However, no immediate policy changes caused BTC to drop as traders remained skeptical.

SEC Shakeup – The SEC removed its top crypto litigator, Jorge Tenreiro, signaling a potential softening stance on enforcement. Some speculate this is a response to growing political pressure and crypto-backed lobbying efforts.

Congressional Crypto Working Group – U.S. Rep. French Hill announced a new initiative to draft pro-crypto legislation, aligning with the White House’s shift toward institutional acceptance of digital assets.

📉 Market Reactions:

Bitcoin dropped 6% to ~$98K, struggling to hold key support amid trade war fears and lack of concrete regulatory changes.

XRP pumped 2.5% to $2.51, while Ethereum (+2.7%) and Solana (+2.8%) also saw marginal gains, suggesting altcoin traders are rotating capital cautiously.

MicroStrategy added another $20.4B in Bitcoin, bringing its total holdings to 471,107 BTC ($30.4B worth), as the company plans to raise another $563M for future purchases.

Tether (USDT) supply on exchanges hit 42.4B, as traders park capital in stablecoins, awaiting regulatory clarity and potential BTC volatility.

📊 Macro Factors Weighing on Crypto:

Trump’s Tariffs on China & Mexico – Trade tensions caused risk-off sentiment, adding selling pressure to BTC.

MicroStrategy’s Q4 Earnings – Expected 9-cent per share loss as the firm continues its aggressive Bitcoin acquisition strategy.

Fed’s Interest Rate Stance – Powell reaffirmed the "restrictive" 4.5% rate environment, keeping risk assets like crypto under pressure.

Why It Matters:

✅ Powell’s pro-crypto shift is bullish long-term but needs policy follow-through before markets price it in.

✅ The SEC’s removal of its top crypto litigator could signal an easier road for institutional adoption.

✅ Watch Bitcoin’s $92K–$108K range—a break below $92K could send BTC toward $80K, while $110K+ is the next breakout target.

✅ MicroStrategy remains all-in on BTC, showing confidence in future upside despite short-term headwinds.

The Daily Newsletter for Intellectually Curious Readers

If you're frustrated by one-sided reporting, our 5-minute newsletter is the missing piece. We sift through 100+ sources to bring you comprehensive, unbiased news—free from political agendas. Stay informed with factual coverage on the topics that matter.

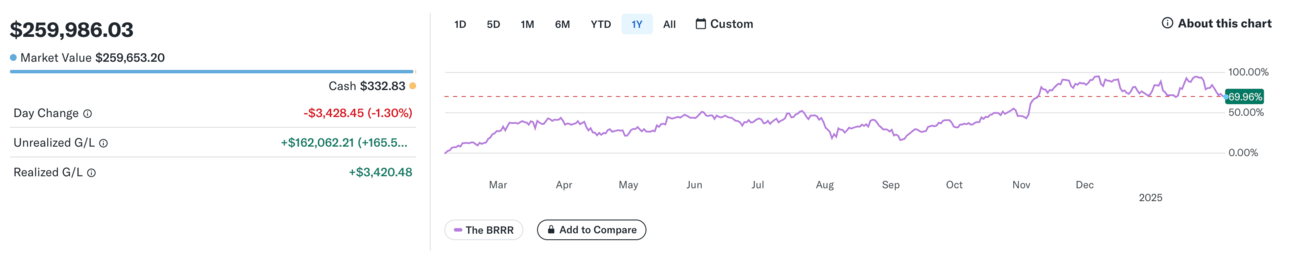

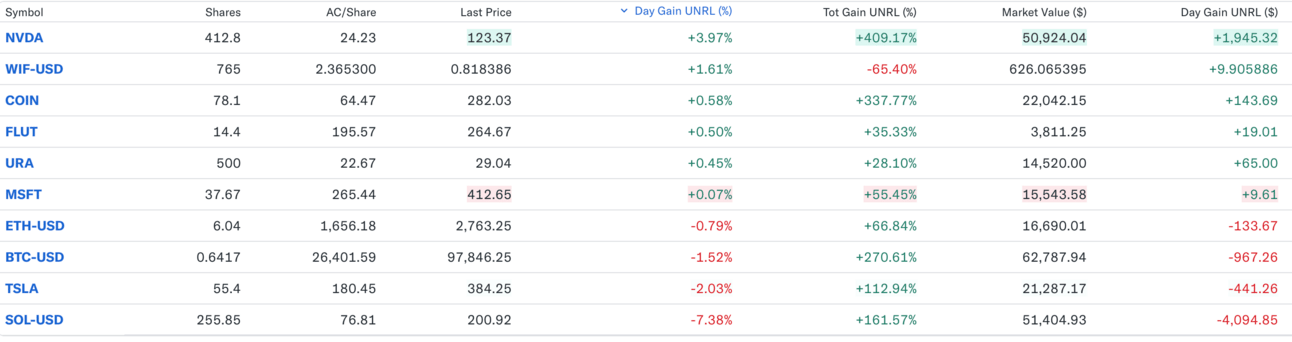

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

Monday November 4 2024: We haven’t updated the portfolio below, but we’re buying AI memecoin GOAT at its current $520m valuation as the fastest horse in a broad crypto rally post-election.

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.