TheBRRR’s Thoughts

GM.

Jay Powell’s took the stage to discuss the Fed’s latest interest rate decision today.

The Fed left rates unchanged at 5.25%-5.5%, as expected, but have conceded that inflation data has been encouraging and that the time to cut rates is likely “approaching”.

Stocks rose into the meeting, continued to rise throughout the 2:30 pm press conference and finished firmly higher.

Crypto did not react as well as stocks, as the majors all fell by about 1% on the day despite climbing by 1% heading into the press conference.

Elsewhere this week, several events and headlines hit the tape this week that have served as bullish catalysts.

1) Treasury doubles rate of bond buybacks from $15B to $30B per quarter

The buybacks serve as a stealth form of quantitative easing - as the treasury is injecting incremental cash back into the markets to support bond valuations, alleviating pressure on interest rates the federal government has to pay on any new bond issuance.

2) Private Sector Job Openings Plunge To 6 Year Low

The weakness in the jobs market can stand alone as a reason for the Fed to start cutting interest rates.

3) Bloomberg Commodity Spot Index Goes Negative On Year

The primary driver of this decline is the faltering economic recovery in China, leading to decreased demand for key commodities like agricultural goods, crude oil, copper, and iron ore.

Lower prices for commodities = dying inflationary pressure = Fed can cut interest rates without risking high inflation.

Powell Takes The Stage, Leaves Door Wide Open For Sept Rate Cut

WHAT HAPPENED

Fed Holds Rates Steady: The Federal Reserve maintained its key interest rate at 5.25% to 5.5%, noting "some further progress" toward its 2% inflation target.

Powell Hints at Rate Cut: Fed Chair Jerome Powell mentioned that a rate cut could be possible in September, contingent on economic data. This led to a surge in stock markets.

Stock Market Response:

Dow Jones: +0.35%

S&P 500: +1.3%

Nasdaq: +2.3%

WHY IT MATTERS

Economic Indicators: The Fed's decision to hold rates reflects a balanced approach to managing inflation and employment, as inflation cools and the job market normalizes.

Market Sentiment: Powell's indication of a potential rate cut provided a much-needed boost to investor confidence, driving significant gains across major stock indices.

Policy Direction: The Fed is now evaluating inflation and employment with closer weight, signaling a potential shift in policy focus if positive economic trends continue.

KEY QUOTES

Powell on Rate Cut: “If that test is met, a reduction in our policy rate could be on the table or as soon as the next meeting in September.”

On Inflation: “The second-quarter inflation readings have added to our confidence and more good data would further strengthen that confidence.”

Dual Mandate Focus: “As the labor market has cooled and inflation has declined, the risks to achieving our employment and inflation goals continue to move into better balance.”

IMPLICATIONS

Investor Optimism: Immediate market reactions show strong investor optimism for potential rate cuts, suggesting a bullish outlook if economic data aligns with the Fed's targets.

Policy Flexibility: The Fed's approach highlights its flexibility in policy adjustments, balancing between curbing inflation and supporting employment.

Economic Monitoring: Close attention to upcoming economic data will be crucial, as the Fed's future actions will heavily depend on sustained positive trends in inflation and employment metrics.

Private Sector Job Openings Plunge To 6 Year Low

WHAT HAPPENED:

Job Openings Drop: Total job openings fell by 46K from 8.230 million in May to 8.184 million in June, above the consensus estimate of 8.00 million.

Private Sector Decline: Private sector job openings dropped to levels not seen since late 2018.

Government Surge: Government job openings surged to a near-record 1.094 million, driven by a 118K spike in state and local job openings.

Quits and Hires Crater: Quits dropped by 121K to 3.282 million, the lowest since August 2020. Hires tumbled by 314K to 5.341 million, the biggest monthly drop since February 2023.

WHY IT MATTERS:

Data Manipulation Concerns: The rise in government job openings appears manipulated to maintain an illusion of a strong labor market amidst broader economic weakness.

Labor Market Weakness: The sharp decline in private sector job openings, quits, and hires signals a weakening labor market and reduced worker confidence.

Questionable Data Accuracy: With over 70% of job openings data being estimated due to a low response rate of 33%, the real state of the labor market is likely worse than reported.

Economic Implications: This report raises questions about the true health of the economy and the effectiveness of current economic policies, suggesting potential underlying economic instability.

Learn AI Strategies worth a Million Dollar in this 3 hour AI Workshop. Join now for $0

Everyone tells you to learn AI but no one tells you where.

We have partnered with GrowthSchool to bring this ChatGTP & AI Workshop to our readers. It is usually $199, but free for you because you are our loyal readers 🎁

This workshop has been taken by 1 Million people across the globe, who have been able to:

Build business that make $10,000 by just using AI tools

Make quick & smarter decisions using AI-led data insights

Write emails, content & more in seconds using AI

Solve complex problems, research 10x faster & save 16 hours every week

You’ll wish you knew about this FREE AI Training sooner (Btw, it’s rated at 9.8/10 ⭐)

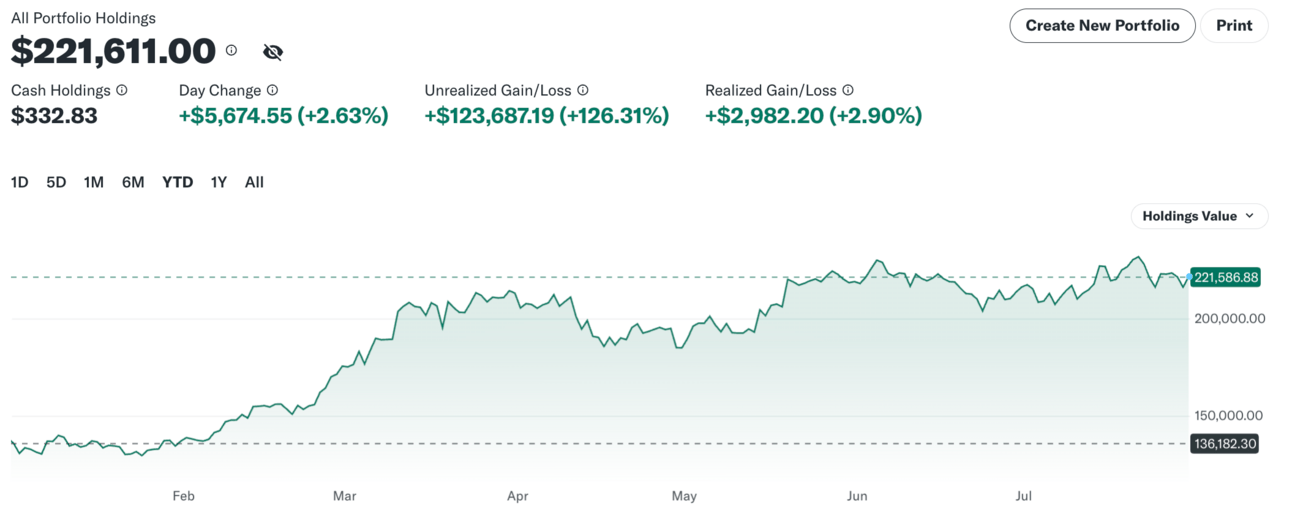

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll