Editor’s note: the podcast is back! We generate a full conversation between two AIs covering the day’s most interesting stories. Subscribe on Spotify and Apple to get notifications when a new episode drops.

You can always read previous updates on thebrrr.com.

TheBRRR’s Thoughts

GM.

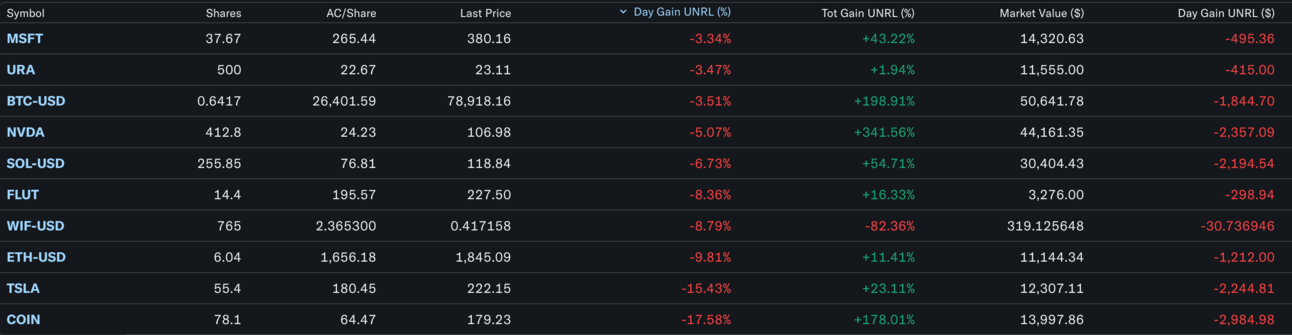

The carnage continued today in yet another volatile session, leaving all bulls bloodied and “Magnificent 7” investors $800B poorer on the day and $3.3T poorer since the top.

Meanwhile, U.S. regulators have quietly freed banks to embrace crypto and Trump has signed an EO to create a strategic bitcoin reserve. The EO pledges that the US will never sell the 200,000 bitcoin in its possession and that the treasury can explore budget-neutral ways to accumulate additional bitcoin.

Despite the positive news flow, bitcoin continues to trade like a “risk-on” asset, falling alongside big tech.

Over in Asia, Japan’s GDP revisions knocked down Q4 numbers, squeezing the BOJ with weaker-than-expected growth.

China scrambles to fight a deflation with a $41B domestic subsidy, twice the size of last year’s and in-line with expectations.

With the slowdown in Asia coupled with austerity measures in the US, the odds of the Fed cutting interest rates in May jumped from 39% to 50% just today - a bet that the Fed’s patience for weak markets will begin to run thin.

We expect China to ramp up its stimulatory efforts, Japan to reverse course on its interest rate hikes, and the US to cut interest rates sooner and more frequently than the market currently expects.

These action will come in response to deeper pain across asset markets - but the reversal will be swift and will likely begin to happen before stimulus and policy changes are announced.

To demonstrate, here’s a potential path for bitcoin that implies a full retrace of the Trump victory pump down to $70K before bouncing back throughout the second half of the year.

CTA Liquidation Ends, But Market Carnage Persists

CTAs (big hedge funds running algorithmic trend-following strategies) completed a massive, algorithm-driven liquidation totaling $193B over two weeks, flipping from a net $200B long to a $10B short position in U.S. equities—triggering a Nasdaq plunge of 13% from peak.

Mag7 tech giants suffered their largest-ever single-day market cap loss ($830B), cumulatively shedding $3.3T from peak valuations amid tariff-driven economic fears and stagflation concerns.

Nasdaq down 4% in a single day (worst drop since Sept. 2022); Tesla erased all post-election gains.

Treasury yields tumbled 7-10 bps amid flight-to-safety; yield curves inverted, and VIX surged, underscoring elevated volatility and uncertainty around delayed fiscal stimulus.

🚨 U.S. Banks Get Crypto Green Light

The OCC reversed Biden-era restrictions, now explicitly permitting banks to hold cryptocurrencies and stablecoin reserves without pre-approval, marking a major pro-crypto regulatory pivot.

This follows Trump’s creation of a strategic Bitcoin reserve, using crypto assets seized from criminals, signaling mainstream financial adoption and bullish sentiment for institutional crypto demand.

China Battles Deflation with $41B Consumption Stimulus

China doubled its consumption stimulus package to $41B, targeting select consumer goods like mid-range smartphones and electric vehicles, covering 15-20% of purchase costs.

Retail sales growth slowed significantly (3.5% last year vs. 7.2% previously), with consumer inflation recently slipping into deflation (-0.1% CPI in February).

Initial effects already notable: electric vehicle sales jumped 80% YoY; smartphone sales surged nearly 65% in response to earlier subsidies.

Long-term structural problems remain, as household spending comprises less than 40% of GDP (global average ~60%), highlighting China’s persistent demand-side weakness despite stimulus measures.

🇯🇵 Japan's GDP Downgrade Complicates BOJ Outlook

Japan's Q4 GDP revised downward to 2.2% annualized growth (from 2.8%), weakening the case for immediate further interest rate hikes.

Private consumption stagnated (0% growth), highlighting consumer weakness despite sustained inflation (core-core CPI at 2.5%, highest since March 2024).

BOJ faces pressure as inflation has exceeded its 2% target for 34 consecutive months, forcing cautious tapering amid global bond sell-offs.

Japanese 10-year bond yields recently surged to highest levels since 2008 (above 1.5%), reflecting market anxiety about policy tightening and economic stagnation risks

Discover 100 Game-Changing Side Hustles for 2025

In today's economy, relying on a single income stream isn't enough. Our expertly curated database gives you everything you need to launch your perfect side hustle.

Explore vetted opportunities requiring minimal startup costs

Get detailed breakdowns of required skills and time investment

Compare potential earnings across different industries

Access step-by-step launch guides for each opportunity

Find side hustles that match your current skills

Ready to transform your income?

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

Monday November 4 2024: We haven’t updated the portfolio below, but we’re buying AI memecoin GOAT at its current $520m valuation as the fastest horse in a broad crypto rally post-election.

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.