TheBRRR’s Thoughts

GM. Equities and risk assets are walking higher in early trading today as geopolitical tension has eased. Iran appears unwilling to retaliate to the theatrical Israeli airstrikes last week so WW3 is now off the table.

This week brings significant earnings from big tech with Tesla on Tuesday, Meta on Wednesday, and Microsoft & Google reporting on Thursday.

The Fed begins a blackout period where they will not comment on the economy or speak at any events, and no significant inflation data will be released this week.

For today’s coverage, we’ve compiled a long-form on the recent happenings at Tesla. From price cuts to robotaxis, to AI and layoffs, we lay out the near future for the largest breakthrough company of the last decade.

Will it continue to perform into the 2nd half of this decade? We lean yes on this question, and are maintaining a position for the newsletter’s portfolio.

Tesla Making Headlines As Stock Tanks In 2024

Price Adjustments and Market Response:

Price Cuts: Tesla has implemented price reductions across its range in major markets including the US, China, and Europe, in response to swelling inventory and disappointing sales in the first quarter of 2024.

Sales Figures: The price adjustments followed Tesla's first-quarter delivery totals which came in at 386,810 vehicles globally, a decrease from previous quarters and below market expectations.

Strategic Shift Towards AI and Robotics:

Corporate Repositioning: Musk has positioned Tesla not just as an automaker but as an AI and robotics leader. This pivot is exemplified by the focus on developing a robotaxi and enhancements to the Full Self-Driving (FSD) capabilities.

Optimus Developments: Tesla has revealed advancements in its humanoid robot, Optimus, showcasing new patents and technologies aimed at enhancing robotic functionality and integration.

Investment in AI: Musk's statements and strategic decisions underscore a shift in Tesla's core business focus from traditional car manufacturing to a broader technology ambit encompassing AI and robotics.

Financial Performance and Projections:

Earnings Expectations: Analysts anticipate a significant downturn in Tesla's Q1 earnings for 2024, with expected earnings per share dropping by over 42% year-over-year to $0.49 and revenues declining nearly 5% to $22.2 billion.

Operational Adjustments: In line with these financial pressures, Tesla has announced substantial layoffs, exceeding 10% of its global workforce, aimed at reducing costs and streamlining operations.

Market Valuation: Despite these challenges, Tesla's forward-looking initiatives like the robotaxi and ongoing investment in AI technology are aimed at revitalizing its growth trajectory and market valuation.

Upcoming Strategic Milestones:

Robotaxi Unveiling: Scheduled for August 8, this event is expected to be a significant indicator of Tesla's future direction and its potential to disrupt the mobility sector.

Shareholder Decisions: Tesla has called for a shareholder meeting to address concerns and ratify strategic decisions, including Musk's compensation plan, which reflects the ongoing adjustments to corporate governance and strategy.

Conclusion: Tesla stands at a critical juncture where its ambitious pivot towards AI and robotics, alongside maintaining its lead in the EV market, will determine its future trajectory. The upcoming earnings report and strategic unveilings will be crucial for assessing Tesla’s ability to manage current challenges and harness its innovative capabilities for future growth.

Commercial Foreclosures Across US Surge in March

Overview: Commercial foreclosures in the U.S. have escalated significantly, rising 6% from February 2024 and a staggering 117% compared to March 2023.

Historical Context: The increase represents a long-term trend from a low of 141 in May 2020, showcasing both the impacts of the pandemic and subsequent economic fluctuations.

Current Figures: In March 2024, there were 625 commercial foreclosures, approaching the previous peak of 889 in October 2014.

State-Specific Data:

California: Leading with 187 foreclosures, though down 8% from the previous month, they have increased by 405% year-over-year.

New York: Recorded 61 foreclosures, up 5% from last month and 65% year-over-year.

Florida: Saw a 30% month-to-month increase and a 107% rise from the previous year.

Texas and New Jersey: Both states showed significant increases, with foreclosures in Texas rising 31% from last month and 129% year-over-year, and New Jersey also up 31% from last month and 133% year-over-year.

Economic Impact:

Banking Sector Pressure: Regional banks, major financiers of commercial real estate, face challenges due to tighter lending conditions and increased need for loss coverages.

Market Conditions: The CRE market downturn is exacerbated by high office vacancy rates, which reached a record 13.1% at the end of 2023.

Price Adjustments: Analysts from Morgan Stanley and Goldman Sachs forecast significant price drops in office spaces, with potential declines up to 50% required for converting commercial buildings to affordable housing.

Federal Response:

Federal Reserve's Stance: Fed Chair Jerome Powell highlighted the ongoing risks in commercial real estate, particularly in sectors like office and retail, predicting continued bank failures but not among the largest institutions.

Policy Implications: The situation poses a sustained challenge that the Federal Reserve expects to address indirectly with rate cuts.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio

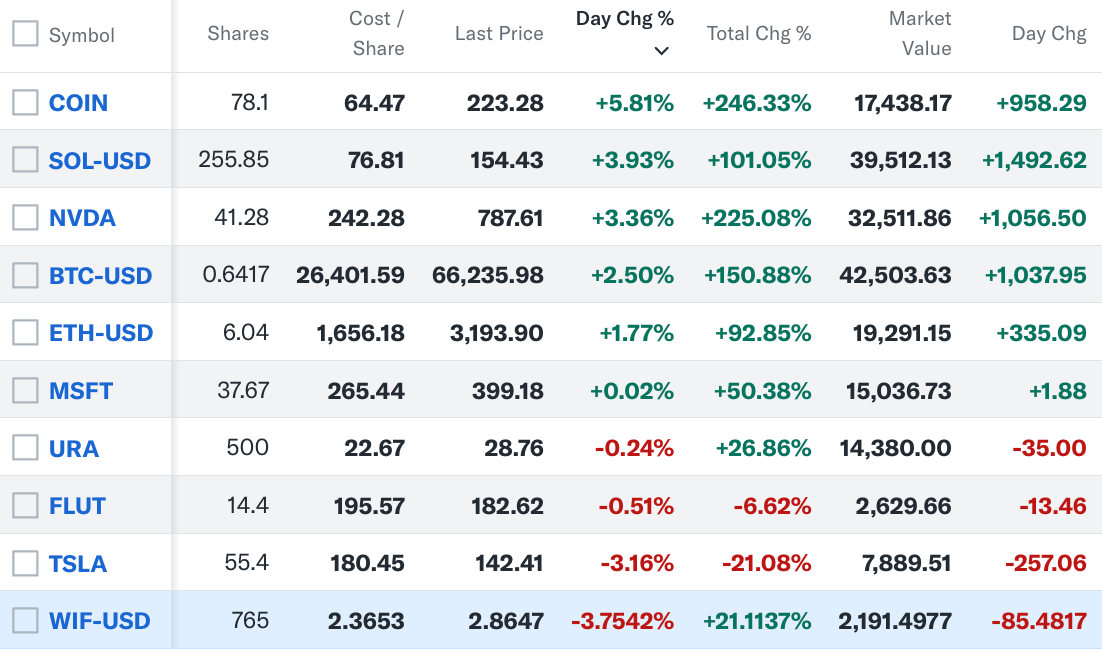

Notes

Wednesday April 17 2024: We bought more Solana and added Solana’s top memecoin WIF on the heels of a leverage wipeout dip after the WW3 scare.

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll