TheBRRR’s Thoughts

GM.

It’s a holiday-shortened trading day in the US, but that’s not stopping the dollar from making a significant move to the downside.

We’ve gotten a flurry of data suggesting the US economy is much weaker than most believe, and the dollar has reacted with weakness as the market begins to price in a higher likelihood of 3 interest rate cuts this year.

The odds of 3 or more cuts have jumped 60% higher from one month ago - from a modest 15% to 24% today.

We may get one more headline-driven move before the holiday with the Fed’s FOMC Meeting Minutes from June set to be released at 2pm today.

Otherwise, the Nasdaq continues to walk higher today with NVDA and TSLA amongst the strongest megacap performers. We dig into the Tesla story in the lead today.

We're also covering some of the weak data coming from ADP’s monthly private sector job growth report, and an analyst predicting 3 rate cuts this year.

Happy 4th of July! Markets reopen Friday after unemployment and wage data drops at 8:30 am premarket.

Tesla Gains On Q2 Deliveries After Months of Underperformance

WHAT HAPPENED

Tesla shares surged 6.5% on Wednesday, following a 10.2% jump on Tuesday.

This rally followed Tesla's Q2 delivery announcement of 466,140 vehicles, significantly surpassing the 439,000 expected by analysts.

Total production for Q2 was 479,700 vehicles, up 8.8% from Q1 and 85.5% year-over-year.

Tesla also deployed a record 9.4 GWh of energy storage in Q2 (Benzinga) (MarketBeat).

WHY IT MATTERS

Stock Performance: Tesla’s shares are up 37.34% over the past three months, indicating strong recovery despite a 6.93% year-to-date decline (MarketBeat).

Energy Storage Growth: The deployment of 9.4 GWh of energy storage suggests Tesla is capturing significant market share in this growing sector.

Competitive Landscape: Tesla remains resilient amidst increasing global competition from Chinese EV makers like BYD and Nio.

Pricing Strategy: Despite steep price cuts to stimulate demand, Tesla exceeded delivery expectations, demonstrating effective strategic moves.

Future Prospects: Tesla’s Q2 financial results on July 19 will be crucial, with analysts expecting earnings of $0.79 per share and revenue of $24.08 billion. Key focus areas include operating margins, advancements in full-self driving technology, and new products like the anticipated robotaxi (Benzinga) (MarketBeat).

Strategic Takeaway

Tesla’s strong delivery and production figures, along with substantial energy storage growth, underscore its robust market position. Effective pricing strategies have boosted demand and investor confidence. Monitoring the Q2 financial results will provide further insights into Tesla’s financial health and future plans.

The Private Sector Job Market Is Ice Cold

WHAT HAPPENED

Private companies added only 150,000 jobs in June, missing the Dow Jones consensus estimate of 160,000 and showing a decline from the revised 157,000 in May.

The leisure and hospitality sector saw the highest gains with 63,000 new jobs.

Wage growth for job-stayers decreased to 4.9%, the smallest increase since August 2021.

Sectors like construction, professional and business services, and trade, transportation, and utilities saw modest gains, while natural resources, manufacturing, and information sectors experienced declines (mediacenter.adp) (adpemploymentreport).

WHY IT MATTERS

Labor Market Concerns: The lower-than-expected job growth suggests a potential cooling of the U.S. labor market. This could signal broader economic challenges ahead, especially if this trend continues.

Sector-Specific Growth: The uneven job growth highlights sector-specific dynamics, with leisure and hospitality driving most of the gains. Without this sector, job additions would have been significantly lower, indicating underlying weaknesses in other areas.

Wage Growth Slowdown: The deceleration in wage growth for those staying in their jobs could impact consumer spending, as households may start to feel the pinch of slower income growth amid persistent inflation concerns.

Regional Disparities: The bulk of new jobs came from the South, which added 80,000 positions. This regional disparity might point to localized economic strengths and weaknesses within the broader national economy (mediacenter.adp) (adpemploymentreport).

ADP's report serves as an early indicator ahead of the Labor Department's nonfarm payrolls data, which is expected to show a higher addition of 200,000 jobs. The consistent undershooting by ADP compared to the Bureau of Labor Statistics (BLS) adds another layer of complexity to interpreting these employment figures (adpemploymentreport).

Lazard Chief Strategist Sees 3 Rate Cuts By End of Year

WHAT HAPPENED

Ronald Temple, chief market strategist at Lazard, predicts that the Federal Reserve will cut interest rates three times this year due to rising unemployment and cooling inflation.

Temple forecasts the Fed will start rate cuts in September, with two additional cuts later, contrasting with the market's expectation of just two cuts by year-end.

Current Fed funds rate stands at 5.25%-5.50%.

WHY IT MATTERS

Economic Forecast: Temple’s outlook hinges on economic weaknesses, with inflation expected to cool and unemployment to rise. He anticipates that by September, the FOMC will have significant data to confirm if price pressures are under control.

Market Dynamics: Despite Jerome Powell’s recent comments on progress against inflation, Temple’s more aggressive stance suggests deeper economic concerns. According to CME FedWatch, the market sees a 24% chance of more than two rate cuts this year.

Sector Impacts: If rate cuts occur, Temple warns they may not significantly lower long-term interest rates, which could be disappointing for prospective homeowners and long-term borrowers. He predicts the Fed funds rate to bottom out at 3.5% or higher, keeping the 10-year Treasury yield between 4%-5%

Political Considerations: The November Fed meeting coincides with the U.S. presidential election week, raising questions about potential political influences. However, Temple believes the Fed will base decisions on economic data rather than political pressure.

Data Points

Fed Funds Rate: Currently at 5.25%-5.50%, with expected cuts starting in September.

Unemployment and Inflation: Predicted to rise and cool, respectively, pushing the Fed towards more cuts.

Market Expectations: As per CME FedWatch, the market expects two 25 basis points cuts with a slim chance of further reductions.

Sectoral Impact: Long-term rates unlikely to decrease significantly, affecting mortgage rates and long-term borrowing costs.

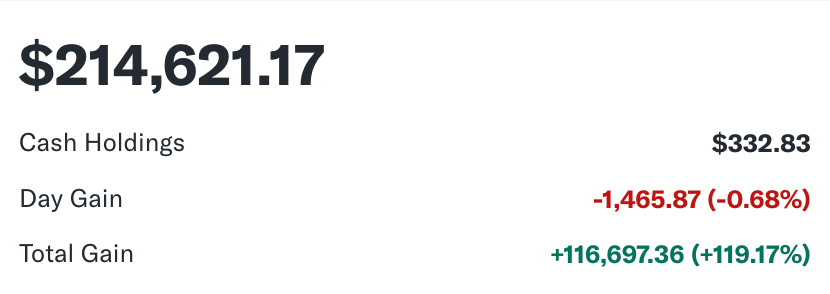

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll