TheBRRR’s Thoughts

GM.

Futures jumped ahead of the stock market open today, kicking off a crucial week where 40% of the S&P 500 reports earnings, and the Fed, BOJ, and BOE make key rate decisions.

S&P 500 futures are up 0.4%, and Nasdaq 100 futures gained 0.6%, showing optimism as hedge funds buy the dip following a tech slump. Bitcoin soared to $70k after Trump’s pro-crypto speech, boosting stocks like Coinbase (+2%), Riot Platforms (+4.3%), and Marathon Digital (+4.5%).

Big tech earnings are in focus, with Apple, Amazon, and Microsoft reporting this week.

Central banks' actions this week could significantly impact markets. The Fed is expected to signal a September rate cut, and the BOJ and BOE have their policy meetings. Market sentiment is also influenced by geopolitical tensions, including Israeli-Hezbollah conflicts.

Crypto has rallied higher since Friday’s close, as Trump appeared at a bitcoin conference to make significant promises as he courts the tech and crypto vote.

Kamala Harris and the Democrats have noticed, and have reportedly reached out to crypto execs hoping to reset relations. This comes on the tail end of a contentious first term defined by a dubiously litigious SEC.

Overall, the market is bracing for a high-volatility week, with tech and crypto at the forefront.

Wildly Bullish Politicians Invade Bitcoin Conference

WHAT HAPPENED

Bitcoin surged 2.5% to nearly $70,000 as hype builds after Donald Trump’s Bitcoin 2024 conference appearance.

Trump has embraced crypto, partly due to his successful Ethereum-based NFT trading cards.

Independent candidate RFK Jr. also made pro-Bitcoin statements, proposing a massive U.S. Bitcoin strategic reserve and an exemption on capital gains.

PROMISES MADE

Significant promises were made by Donald Trump, Robert F. Kennedy Jr. (RFK Jr.), and Senator Cynthia Lummis, highlighting their pro-Bitcoin stances and proposed policies.

Donald Trump:

Bitcoin Donations: Trump became the first U.S. President to accept Bitcoin via the Lightning Network for campaign donations. He announced he had raised over $25M in crypto to date.

Pro-Bitcoin Agenda: He pledged to support Bitcoin mining in the U.S., uphold the right to self-custody for crypto holders, and codify the US’ stash of over 200,000 bitcoin as a strategic reserve asset that the country would “never sell”.

Fire Gary Gensler: Trump pledged to fire the hostile head of the SEC on “day 1”.

Additionally, Trump committed to commuting the sentence of Ross Ulbricht, the Silk Road founder, if re-elected.(Bitcoinist.com) (Bitcoin Magazine).

Robert F. Kennedy Jr. (RFK Jr.):

Bitcoin Strategic Reserve: RFK Jr. proposed transferring the 204,000 Bitcoin held by the U.S. government to the Federal Reserve as a strategic reserve.

Buy More: He also suggested the Treasury Department should purchase 500 Bitcoin daily until the reserve reaches at least four million Bitcoin, aiming to position the U.S. as a dominant force in the global crypto market (Bitcoinist.com).

Tax Exemption: RFK Jr. announced plans to make Bitcoin-to-U.S. dollar conversions exempt from capital gains taxes. He argued this would spur investment and incentivize businesses to grow within the U.S. rather than moving to more crypto-friendly jurisdictions (CoinDesk) (Cointelegraph).

Critical Fed FOMC Meetings To Commence This Week

WHAT HAPPENED:

The Federal Reserve is gearing up for a pivotal meeting this week, with the possibility of signaling a rate cut in September.

Despite the potential for a rate cut, no immediate changes are expected at this meeting.

Fed officials have been cautious due to previous surprises with inflation and want more evidence of cooling inflation before making a move.

Key indicators driving this discussion:

Inflation: A measure excluding food and energy prices fell to 2.6% in June from a peak of 5.6% two years ago.

Labor Market: Unemployment rose to 4.1% in June from 3.7% last year, signaling a cooling market without heavy inflationary pressures.

WHY IT MATTERS:

Inflation Progress: The steady decline in core inflation suggests the Fed's aggressive rate hikes are finally taming price increases, inching closer to the 2% target.

Labor Market Stability: Slower hiring and a rise in unemployment indicate reduced inflationary pressures, supporting the case for a rate cut.

Economic Balancing Act: The Fed's delay in rate hikes two years ago led to rapid, steep increases, and there's now a cautious approach to avoid over-tightening or undercutting economic growth.

Risk Management: With better inflation data and a cooler labor market, the Fed must balance the risk of rising unemployment against the need to keep inflation in check.

Strategic Patience: Some officials, like Chicago Fed President Austan Goolsbee, argue for cuts due to significant tightening already achieved. Others, like San Francisco Fed President Mary Daly, urge caution to ensure sustained price stability.

CONCLUSION: The Fed's upcoming meeting will likely set the stage for a September rate cut, contingent on continued favorable economic data. This cautious yet optimistic outlook highlights the intricate balancing act central bankers face in steering the economy towards a soft landing.

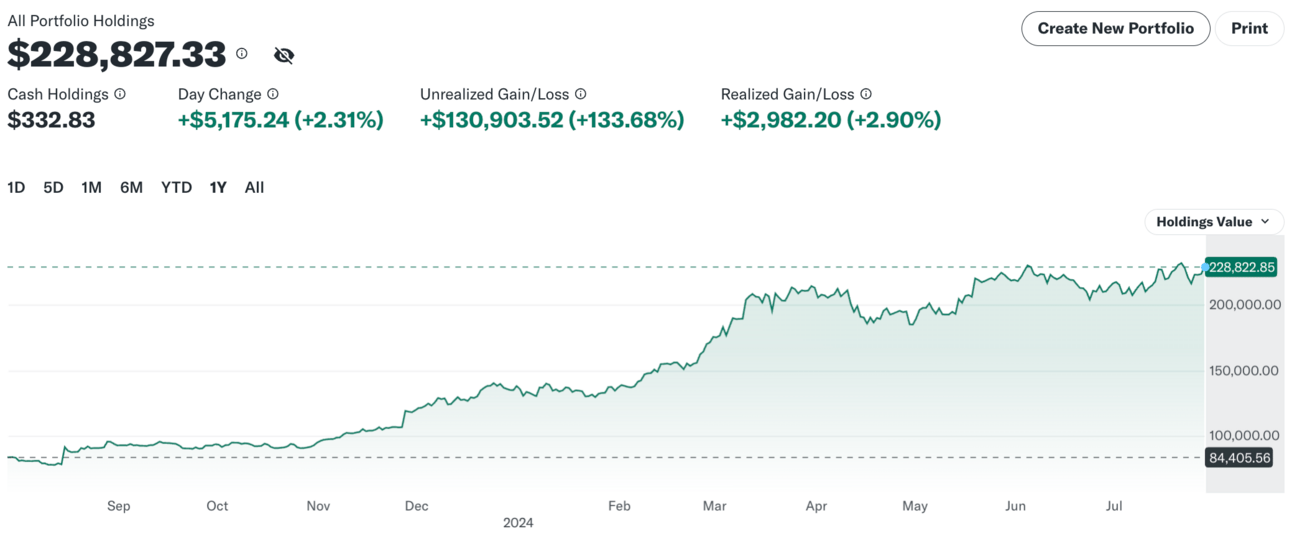

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll