GM and BRRR. No contest question today because of the long weekend. We’ll be back on Monday. Learn about the contest here.

Today was a quiet news day overall. Markets didn’t move much.

We got more bad data - in the week ending April 1, there were 228k new jobless claims vs 200k expected. They also dramatically revised the previous week up to 246k from 198k.

This is the first real sign of weakness in the job market, and the job market is what Jay Powell & Co have pointed to as evidence the economy is still strong enough to handle high interest rates. Let’s see if they start to flinch.

Here’s what we brrr’d today:

Bulls' hopes dashed as labor market goes to the cryptos, while IMF downgrades global growth

The Dollar’s demise: Biden’s policies pushing other currencies into the limelight

Labor Markets hopes crushed, Big Banks and Tech take a hit

The labor market surprises have been carrying the hopes of every equity market bull and soft-landing believer but were dashed by the reality checks.

Jobless claims data revisions are bad for the labor market and bad news for the recession fears building.

The IMF downgraded global growth to its weakest in over 30 years.

The yield curve recession signal massively flattened to record levels of inversion.

The dollar ended the short week lower.

Cryptos were mixed this week, with Bitcoin slightly lower, Ripple lagging, and Ethereum outperforming.

Gold surged this week to its second-highest weekly close ever.

The STIRs market is ignoring any and all FedSpeak and DotPlots about higher for longer rates.

The market was pricing in 100bps of hikes by year-end after Powell's hawkish comments on March 8th and swung to pricing in 105bps of cuts by year-end on March 24th.

Biden’s Plan for the Dollar: No longer world’s currency

Joe Biden is challenging the dominance of the US dollar as the world's reserve currency

Recent events such as China conducting major sales in renminbi instead of dollars and striking deals with Brazil to conduct trade in their own currencies are contributing

The Biden administration's inflationary policies and sanctions on Russia are also accelerating the flight from the dollar

Since the Bretton Woods agreement in 1944 and the petrodollar deal in 1945, the dollar has been the preeminent currency for international trade and exchange

Ending the dollar's link to gold in the 1970s allowed the Fed to create more money and inflation, which has now returned with a vengeance

The stability and apolitical nature of the dollar are necessary characteristics for a reserve currency, but both have been threatened by inflation and Biden's use of the dollar as a weapon

The seizure of Russia's central bank's dollar reserves exposed the Biden administration's willingness to violate the trillions of dollars owned by foreigners, creating a dangerous precedent

China has been making rapid progress in replacing the dollar as the world's reserve currency

If de-dollarization progresses, trillions of dollars accumulated around the world may flood back to the US, leading to hyperinflation

Daily Caller via ZeroHedge

AI ART OF THE DAY

If we’re living in a simulation, this is real in at least a handful of timelines

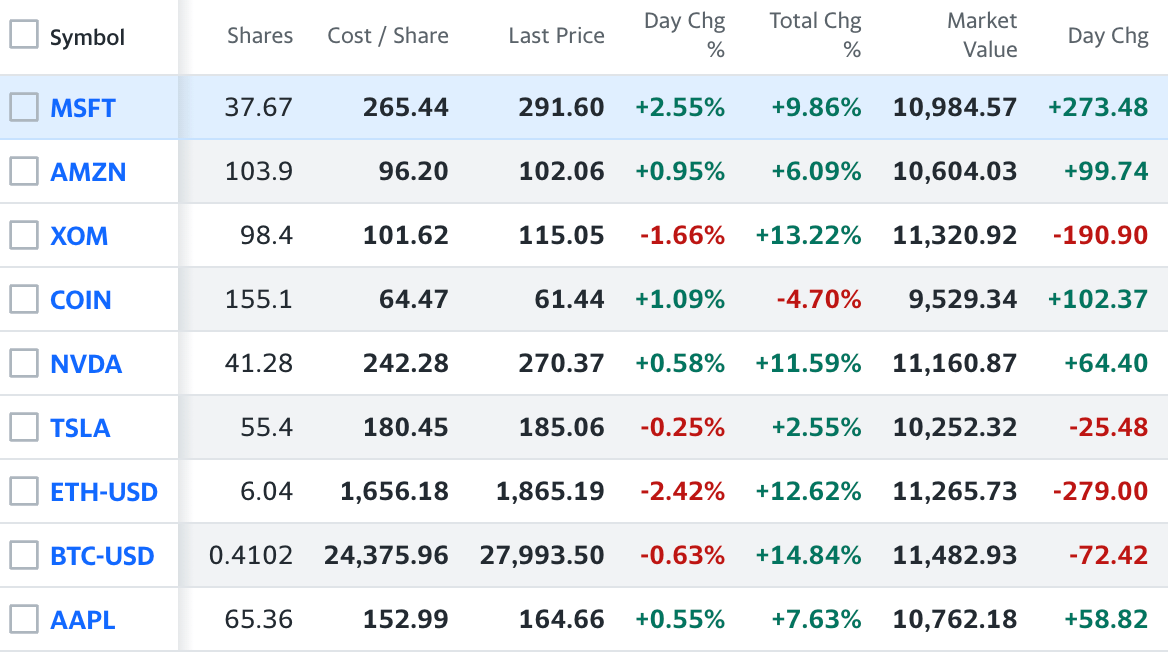

The BRRR’s Portfolio

Down bad today - Exxon was the lone asset in the green.

Here’s your link to qualify for the Prediction Contest $100 Prize 👇

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.