TheBRRR’s Thoughts

Recall back in February when the Bureau of Labor Statistics released an incredible monthly non-farm payroll report we essentially called BS on the huge expectations beat.

Alas, when the BLS released its revisions to that report earlier today, they walked back the number from 353,000 to 229,000. Oops.

So when the BLS announced 275,000 incremental workers for month of February (against expectations of 200,000), we’re again taking it with a grain of salt.

Additionally, the unemployment rate moved up to 3.9% vs an expected 3.7% last month.

This weaker-than-expected labor market gives the Fed additional reason to cut interest rates, so risk assets are poised to benefit as world’s leading central bank continues to debase the world’s reserve currency.

What could go wrong?

Well, you can avoid the debasement of your savings by remaining invested in risk assets.

Bitcoin again nudged up to a new all-time high this morning as the crypto bull market appears poised for another leg higher.

On aggregate, more money has been made buying all-time highs than any other strategy.

Let that sink in!

The Rundown is the world’s fastest-growing AI newsletter, with over 500,000+ readers staying up-to-date with the latest AI news and learning how to apply it.

Our research team spends all day learning what’s new in AI, then distills the most important developments into one free email every morning.

February Jobs Soar By 275K, January Revised Sharply Lower, and Unemployment Ticks Up to 3.9%

February Jobs Soar By 275K, Smashing Estimates, But January Revised Sharply Lower And Unemployment Rate Jumps To 2 Year High

WHAT HAPPENED:

February saw a massive increase in jobs, with 275,000 positions added, far exceeding the expected 200,000. This surprise beat comes amidst a sharp revision of January's figures, from an initially reported 353,000 down to 229,000.

Unemployment rate ticked up to 3.9%, hitting its highest since January 2022, contrary to the steady 3.7% forecast.

A notable divergence persists between the Establishment survey (payrolls) showing job growth and the Household survey (actual number employed), which saw a decrease, hinting at people taking on multiple jobs.

WHY IT MATTERS:

This mixed bag muddles the economic outlook, with strong job additions but revisions and rising unemployment indicating underlying volatility.

Market Reaction: Despite the conflicting signals, the job report's initial figures led to a spike in futures and a dip in the dollar, reflecting investor optimism for interest rate cuts.

Wage growth has slightly cooled, with average hourly earnings growing at 4.3% year over year, potentially easing some Fed concerns about wage-induced inflation pressures.

Key Sectors:

Gains were noted in health care, government, food services and drinking places, social assistance, and transportation and warehousing, indicating sector-specific recoveries.

China Launches $27B Chip Fund to Counter US Restrictions

WHAT HAPPENED:

Export Controls: The U.S. has implemented stringent export controls on cutting-edge technology, particularly in the semiconductor sector. These controls limit China's access to advanced semiconductor manufacturing equipment, materials, and software from American companies.

China is ramping up its semiconductor game, initiating a $27 billion fund aimed at advancing its chip technology. This move comes as a strategic counter to the United States' efforts to limit China's progress in chips and artificial intelligence through export controls.

This initiative is a part of China's push for technological self-reliance, reflecting a broader strategy to navigate through US and allied countries' tightening semiconductor technology restrictions.

WHY IT MATTERS:

Strategic Autonomy: China's aggressive funding for chip development underscores its commitment to achieving self-sufficiency in semiconductor manufacturing, a critical sector given its role in everything from consumer electronics to military hardware.

International Tensions: The fund's expansion reflects growing tensions between China and the US, with technology and access to critical components like semiconductors at the heart of their strategic rivalry.

Economic and Security Implications: The ability to produce advanced chips domestically is not just an economic booster for China; it's also a matter of national security, reducing dependency on foreign technology that can be subject to restrictions and sanctions.

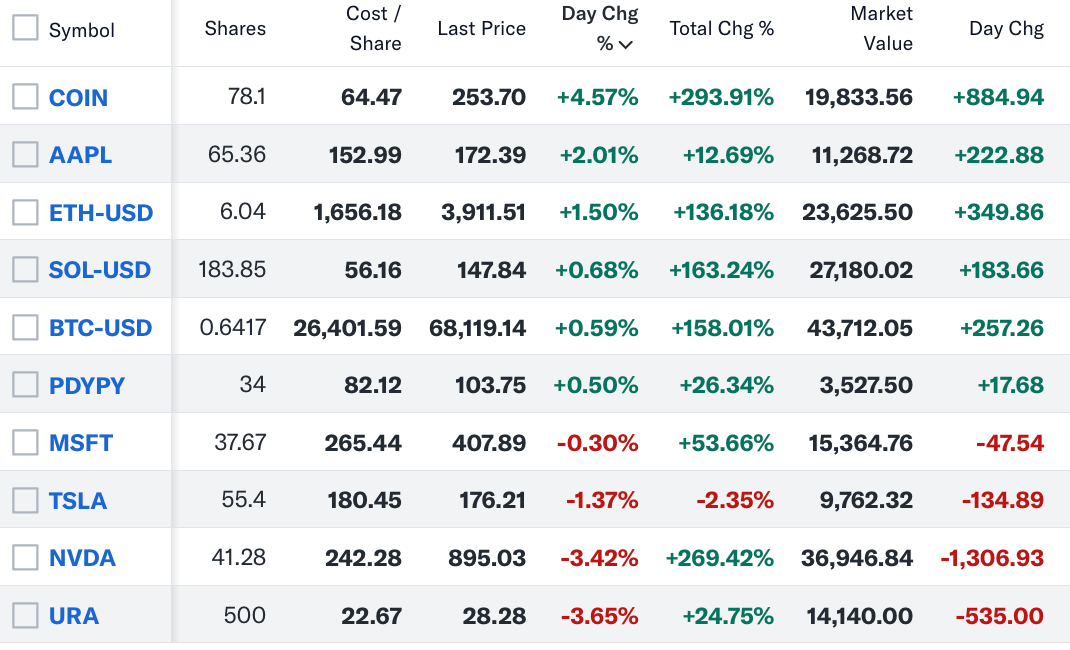

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

We bought Solana and announced it to premium subscribers on November 28th. It’s up 77% since.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Solana’s up 106% since we bought and should continue to run. 🔥

Portfolio

Notes

Wednesday 11/29/23: We sent out the alert that we were buying Solana yesterday as we go full risk-on to close out the year.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll