TheBRRR’s Thoughts

Chinese stocks came under pressure to start the week. When the week’s trading opened, stocks in Beijing sank universally as indexes set fresh 5-year lows with the small-cap index falling by as much as 8%.

Stocks recovered by market close, recovering roughly half of the losses as relaxed banking standards (lowering reserve requirements) came into effect.

There wasn’t an obvious cause, but many pointed to new comments from Presidential hopeful Donald Trump where he proclaimed he’d institute a 60% tariff on Chinese imports.

In the past, he’s expressed that China doesn’t play a fair game by devaluing their currency and instituting tariffs of their own.

US markets followed the Chinese weakness today, but recovered most of the losses through the afternoon.

Crypto broadly fell lower, but remains range-bound with bitcoin sitting at $42.5k - a level it has bounced around since its 2023 bull run (+160%) started to cool off in early December.

Powell Talks to 60 Minutes, Reiterates Interest Rate Path, Calls Americans Lazy

WHAT HAPPENED:

Federal Reserve Chair Jay Powell indicated the central bank plans three quarter-point rate cuts in 2024, diverging from market expectations of six cuts.

In a CBS’s 60 Minutes interview, Powell noted that current economic conditions haven't significantly altered the Fed's forecast since December, when they projected 75 basis points of cuts.

Despite speculation of an early start to rate cuts, possibly in March, Powell's comments and a robust January jobs report have cooled those expectations. The U.S. economy added 353,000 jobs, nearly double the forecasted amount, suggesting a strong labor market.

Controversial Remarks on Immigration: Powell touched on the topic of immigration, suggesting immigrants have been integral to the labor market's strength, indirectly highlighting a contrast with native workforce participation rates on the decline, insinuating Americans are lazy.

WHY IT MATTERS:

Market Misalignment: Powell’s stance highlights a discrepancy between the Federal Reserve’s outlook and market expectations, potentially impacting investor strategies and financial markets.

Economic Strength: The robust job growth and the Fed's cautious approach to rate cuts suggest confidence in the U.S. economy's resilience, despite aggressive rate hikes over the past 18 months.

Inflation and Policy Implications: With inflation expected to continue its downward trend, the Fed's planned rate cuts aim to balance stimulating economic growth while ensuring inflation moves towards the 2% target. The timing and pace of these cuts will be crucial in navigating economic recovery without igniting inflationary pressures again.

Political Dynamics: Powell's comments come amid an election year, making the Fed's decisions even more scrutinized for potential political implications. His remarks aim to distance the Fed's monetary policy decisions from political influences, emphasizing data-driven decisions.

Trump Threatens 60% Tariff on Chinese Goods, Chinese Stocks Tank

WHAT HAPPENED:

Chinese stocks plummeted significantly, with the Shanghai Composite dropping 3.1% to a five-year low, and the broader CSI 1,000 Index also experiencing a steep decline. Over $1 trillion was erased from China's market capitalization in just 13 trading days, underscoring a deepening crisis in investor confidence.

Donald Trump's Tariff Threats: In a Fox News interview, Trump hinted at imposing tariffs of more than 60% on Chinese goods if re-elected, exacerbating fears among investors and contributing to the market downturn.

Beijing's Response: Despite vows from the China Securities Regulatory Commission to stabilize the market and curb illegal activities like short selling and insider trading, concrete actions remain elusive, leaving markets in turmoil.

WHY IT MATTERS:

Economic and Political Ripple Effects: Trump's aggressive tariff stance signals potential for heightened US-China tensions, affecting global trade dynamics and economic stability.

Investor Sentiment and Market Stability: The sharp decline in Chinese stocks reflects deepening concerns over economic policies, geopolitical tensions, and regulatory crackdowns, potentially leading to broader implications for global markets.

Beijing's Dilemma: The Chinese government faces a critical challenge in restoring confidence in its financial markets and broader economy amidst escalating external pressures and internal discontent.

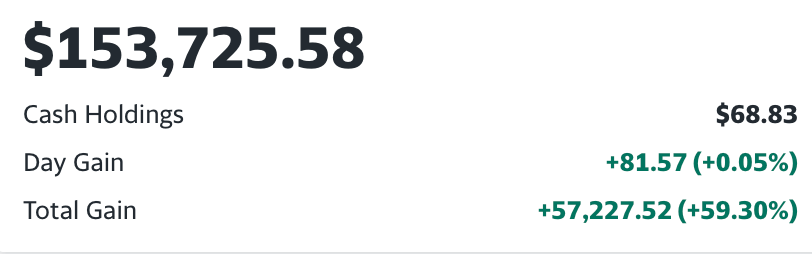

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

We bought Solana and announced it to premium subscribers on November 28th. It’s up 77% since.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Solana’s up 70+% since we bought and should continue to run. 🔥

Portfolio

Notes

Wednesday 11/29/23: We sent out the alert that we were buying Solana yesterday as we go full risk-on to close out the year.

Latest Trades

Tuesday 11/28/23 11:20 AM: BUY 183.85 SOL @$56.16

Tuesday 11/28/23 11:20 AM: SELL 101.62 XOM @$104.75

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll