GM and BRRR.

Hope everyone enjoyed the extended weekend and the conclusion of summer. Markets typically come alive in September, so we’re expecting volatility in one direction or the other over the final four months of the year.

Although so far, market moves have been muted as the Fed continues to signal “high interest rates for longer than you think”, while institutions, hedge funds, and retail call the Fed’s bluff, hiding in big tech equities like AAPL, NVDA, and MSFT.

In today’s newsletter we’re covering Tesla’s aggressive price cuts and the recent tailwind in the Uranium rally. We added $URA (Uranium ETF) on August 21 and announced it to our premium subscribers.

The move looks well-timed, as $URA has since rallied 10%.

This morning we added a new stock to the watchlist, and am eyeing a significant rebalance. To see what we added, and to be the first to know when we do make a move, you’ll need to be a premium subscriber.

For just $2/month or $12.99/yr, you’ll unlock trade notifications and a full view of our actively managed portfolio (+25% since inception in March).

Today’s newsletter is brought to you by The AI Tool Report. Please consider subscribing and opening their emails - it’ll directly support us at The BRRR. 👇

What Else I’m Reading

The AI Tool Report Learn AI in 5 Minutes Per Day. The AI Tool Report does an outstanding job surfacing the most practical AI breakthroughs that you can actually leverage today.

Here’s your link to subscribe for free.

Market News

Tesla Model S & X Cheaper; Standard Gone

Tesla has made significant adjustments to its pricing strategy, with a notable reduction in the prices of the Model S and X by 15-19% in the US and similar reductions globally. All paint colors are now included in the base price, and due to the US Federal EV Tax Credit stipulations, the Model X could potentially be more affordable than the Model S after incentives.

Tesla has been known for its frequent price adjustments, with several significant reductions this year, including a $3k cut for Full Self-Driving.

Two potential reasons for the price drops include the Inflation Reduction Act's MSRP cap and the unveiling of the "Project Highland" Model 3 Refresh, which might overshadow the Model S's features.

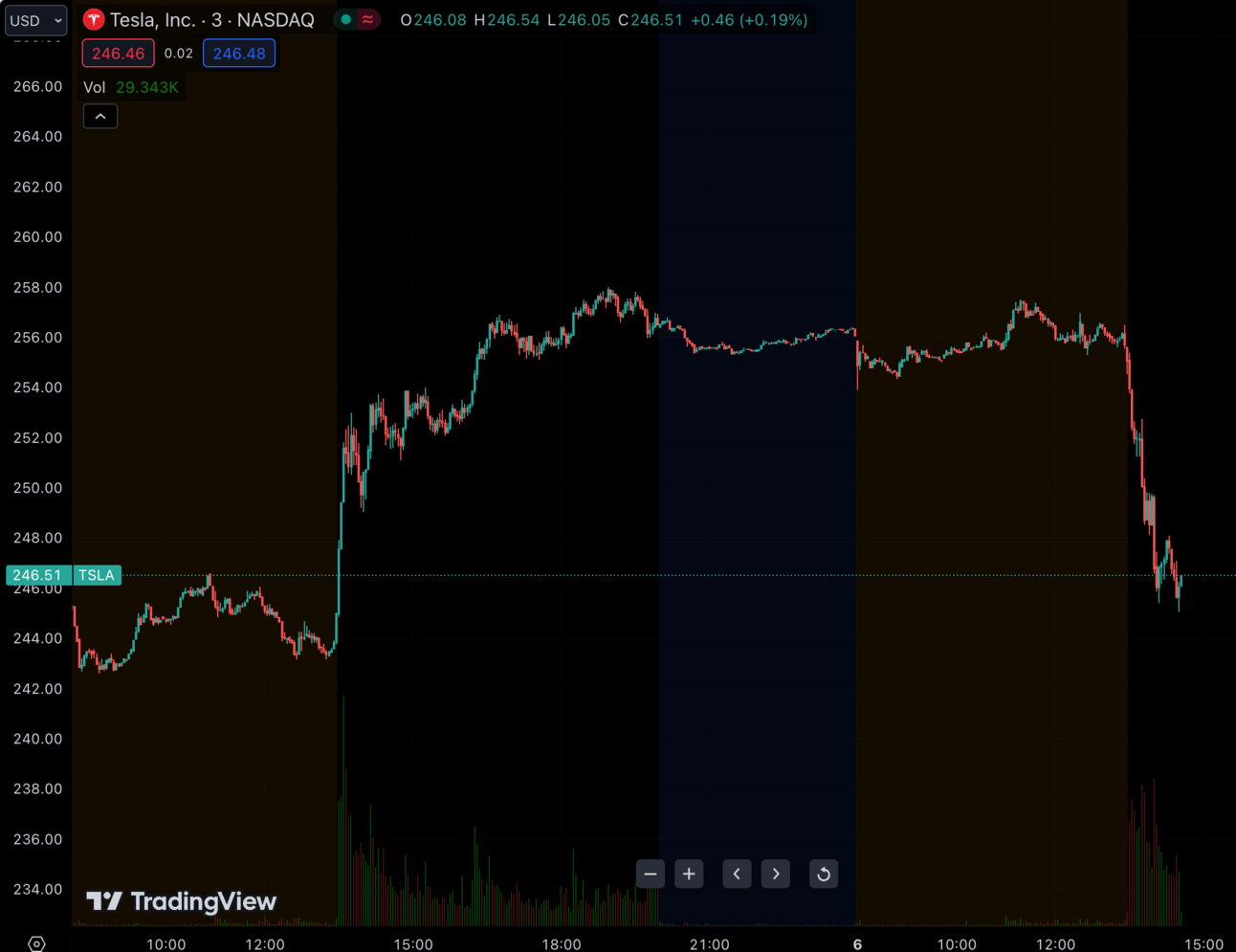

The stock initially soared to start the week, but has since fallen back to last week’s levels.

Lower Base Prices: Tesla has cut base prices by $3,500 on the Model S and $8,500 on the Model X. This brings the new starting prices to $74,990 for the Model S and $79,990 for the Model X.

Bigger Batteries Now Standard: The base models now come standard with the larger battery packs previously reserved for the more expensive trims. This means 405 miles of range on the base Model S and 348 miles on the base Model X.

Plaid Variants More Affordable: In addition to the lowered base prices, Tesla has cut prices on the performance Plaid variants of both models. The Model S Plaid is now $89,990, down from $108,490 previously. The Model X Plaid also sees a significant price reduction.

Macro News

Uranium: Not Just for Nightlights Anymore

Both uranium equities and spot prices have surged in 2023, with bellwether Cameco up over 50% this year. The uranium mining sector has substantially outperformed broader markets over the past 5 years.

This strength has been driven by a resurgence in long-term contracting by utilities, supply concerns due to geopolitical instability, and project delays across the industry.

With demand slated to rise amidst a wave of new reactors coming online, secondary supplies declining, and ambitious climate goals requiring substantial electrification, uranium fundamentals appear strong.

Price and Equities Surge: Uranium spot prices have jumped over 25% year-to-date to around $60/lb, the highest level since 2011. Cameco, the world's 2nd largest producer, is up over 50% in 2023 to its highest level since 2008. An index of uranium miners has returned 21% annually over the past 5 years, outpacing most major asset classes.

Factors Driving Prices: 2023 is on pace to see the most new long-term utility contracts signed in over a decade. However, political instability in Niger, Kazakhstan, and Russia raises supply security concerns. There are 57 nuclear reactors currently under construction globally in 17 different countries, mostly in Asia.

Demand and Supply Dynamics: Uranium demand often surpasses mined production. Secondary supply sources are depleting, necessitating mined supply to bridge the gap. The push for electrification to achieve climate goals will increase electricity demand. Nuclear energy, despite its challenges, might play a crucial role in a decarbonized future due to its CO2-free energy production.

Today’s Reader Poll

In our last poll, we asked Will the Nasdaq finish 2023 higher or lower than $14,000?

The results were very mixed, with LOWER (51.85%) slightly outpacing higher.

And for today’s question, let’s see if our readers plan to bet on NFL football. Per CNBC, 73m Americans plan to do so this season, +60% y/y.

Do you expect to place a bet on at least one football game this season?

AI Art of The Day

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $2/month or $9.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

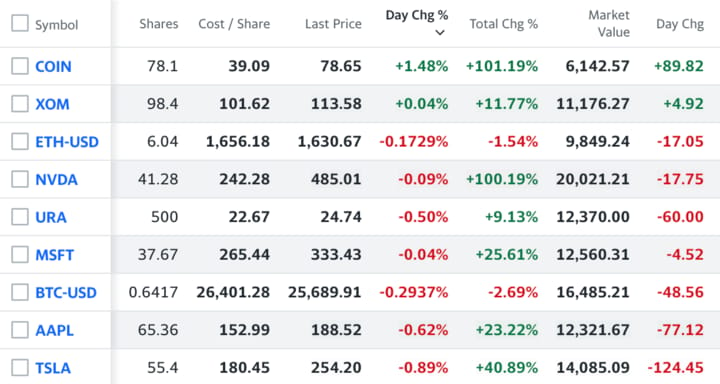

We initiated a position in $URA two weeks ago - it’s an ETF that tracks the price of Uranium. We’ll publish our longer thesis on the reason soon, but as we wrote last week, we believe the Nuclear Energy narrative is gaining steam very quickly.

We also added Draftkings to the Watchlist, as we think sports betting has strong tailwinds that are still unaccounted for this year. We may buy later this week.

Latest Trades

Monday 8/21/23 9:30 AM: BUY 500 URA @ $22.67

Wednesday 8/16/23 10am: SELL 103.9 $AMZN @ $136.6

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

$PLTR: AI for government intelligence

$DKNG: Sports betting revenue may beat expectations this quarter

Portfolio

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.