Yellen stressed about debt ceiling

GM and BRRR.

Editor’s Note: We started a daily podcast version of the newsletter. If you’d like to subscribe, it’s called Money Printer Go BRRR Podcast across all the podcast players. Here are the links to it on Spotify and Apple.

Today is marred by bad news across the financial world. The UK printed an embarrassing 8.7% CPI y/y with interest rates still only at 4.5%, lagging the US by 75 basis points.

The debt ceiling theatrics continues to drag, but BRRR readers don’t buy the drama. 88% of our voters believe it’ll be resolved before the end of the month.

Here’s what we brrr’d today:

UK CPI Lands at 8.7% Year-On-Year

Wednesday Market Report

UK CPI Lands at 8.7% Year-On-Year

UK Inflation Down But Still Hot: According to the Office for National Statistics (ONS), UK's inflation witnessed a drop in April, with the headline CPI at 8.7% year-on-year, down from 10.1% in March. The decline was mainly due to retreating energy prices. Nevertheless, the inflation is still higher than the expected 8.2%.

Persistent Inflation amid Economic Resilience: Despite the decline, UK's inflation has stayed high, even as the economy avoided anticipated recession. In reaction to stubborn inflation, the Bank of England has hiked interest rates 12 consecutive times to 4.5%, which is still lower than the US’ rate of 5.25%

Analysts Suggest Quick Inflation Fall: Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales, suggests that the drag on customer demand from a cooling jobs market, higher taxes, and the lagged impact of rising interest rates may cause inflation to fall more rapidly than the Bank of England's forecast. He expects significant falls over the summer, particularly with UK energy regulator Ofgem's anticipated reduction of the energy price cap.

Wednesday Market Report

Global Market Conditions: US equity futures and European stocks are trending downwards today, influenced by a series of negative global events including a major drop in European stocks, a decrease in the price of copper, and a halt to the year's gains in China equities. Commodities show a mixed pattern, with energy rallying (WTI + 2.1%) and metals falling due to concerns over China's slowing recovery. The US dollar is slightly stronger, and bitcoin has taken a hit. S&P futures were down 0.4% to 4,143 and Nasdaq futures slid by the same percentage.

Concerns Over Economic Outlook: Investors have multiple reasons to be concerned, including a lack of progress in US debt-ceiling talks, fears of a US default, and China's struggling economy. Other factors include a high UK inflation rate, hinting at possible stagflation, and a potential bursting of Europe's luxury stocks bubble.

Stocks and Currencies: European stocks are heavily in the red due to worries of further monetary policy tightening, with the Stoxx 600 Index experiencing its biggest intraday loss since March 24. Asian stocks are mostly lower, influenced by Wall Street's sentiment and US-China frictions. In terms of currencies, the Bloomberg dollar index remains unchanged, with Sterling fluctuating in response to the UK's hotter-than-expected CPI.

AI ART OF THE DAY

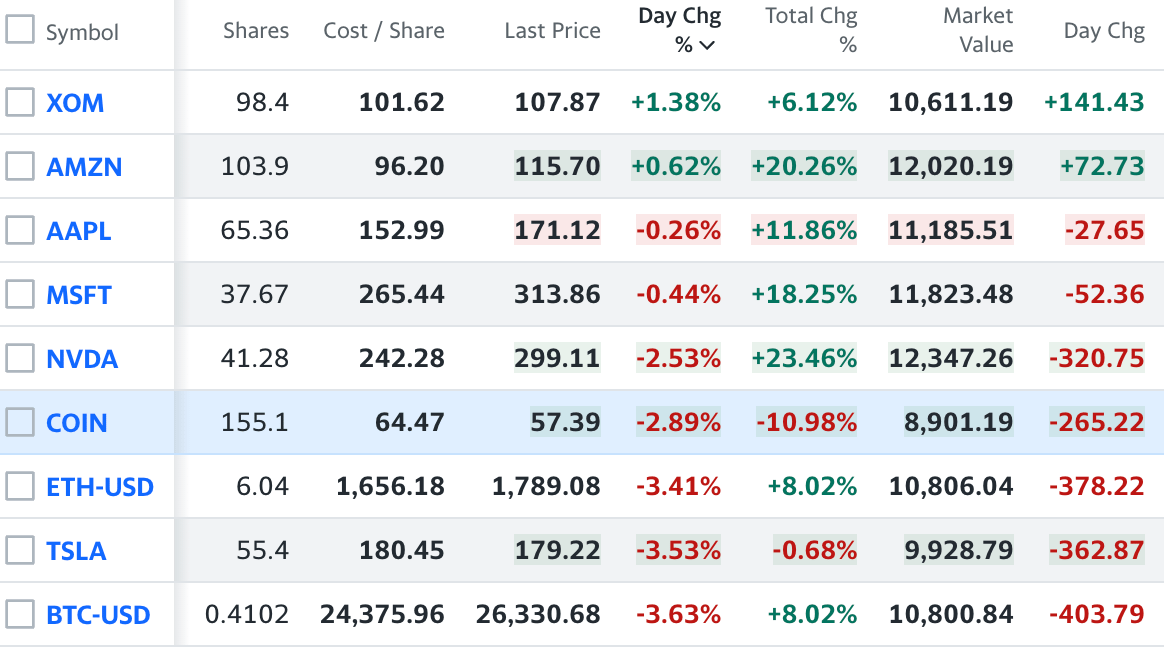

The BRRR’s Portfolio

Back under $100k we go. I still feel strongly that the 9 assets in this portfolio are great buy and holds. I’m tempted to trim NVDA at these levels to become a little more defensive after capturing 23% in 2 months, but that would create a new problem - where would I put the proceeds?

There’s no good answer so we hodl on.

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.