TheBRRR’s Thoughts

Editor’s note: the podcast is back! We generate a full conversation between two AIs covering the day’s most interesting stories. Subscribe on Spotify and Apple to get notifications when a new episode drops.

GM

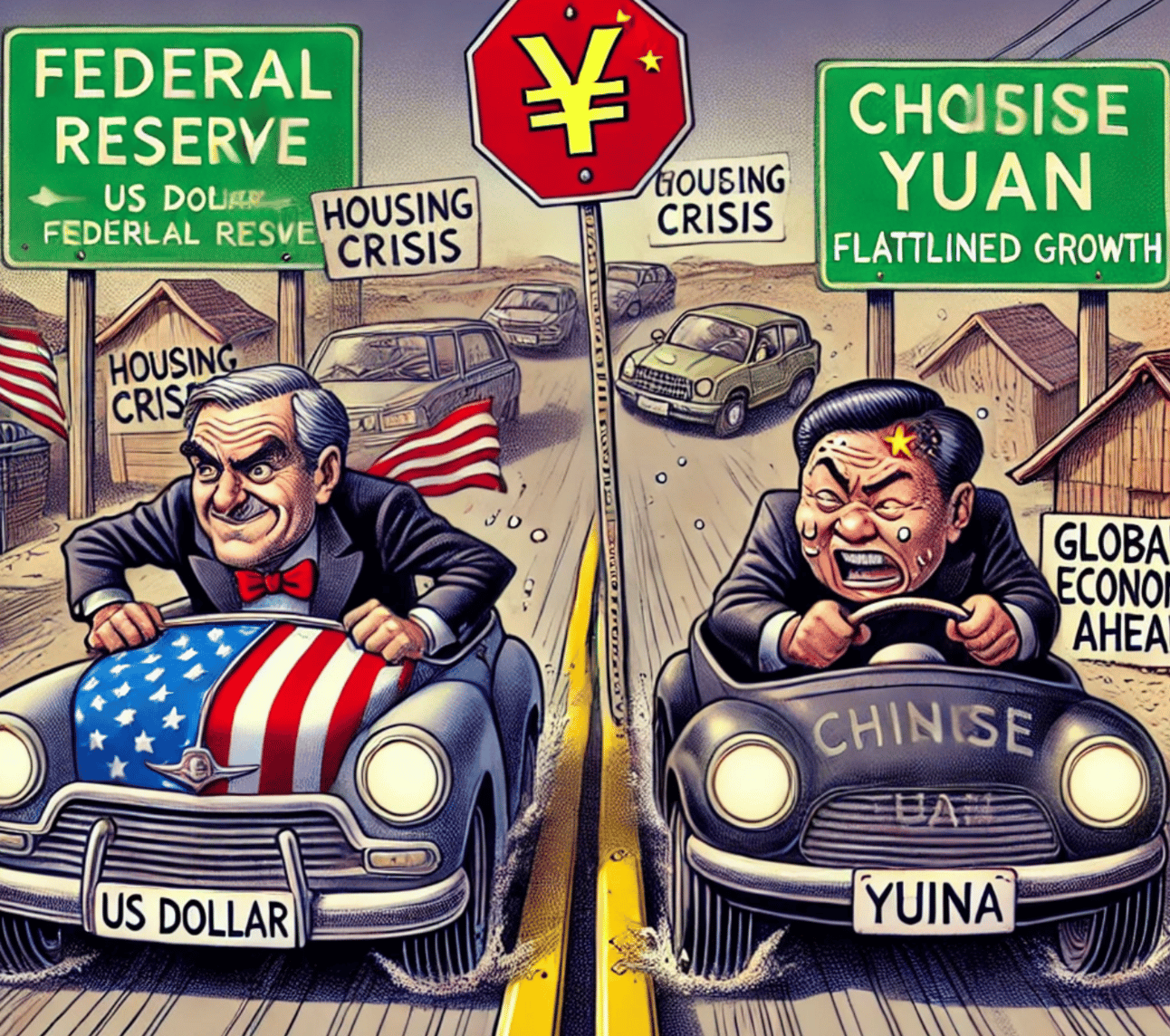

There’s a game of chicken going on between the US and China dictating the movement in global risk asset prices.

The US dollar has surged higher over the last 3-4 months as the Federal Reserve and US Treasury have pumped the breaks on interest rate cuts and dollar liquidity injections into the banking system.

With the dollar so strong, every other currency has collapsed in value in comparison, including the Chinese Yuan.

China desperately wants to stimulate their economy, as growth has flatlined and prices for goods and services have declined. China - through austerity measures and authoritarian COVID policy - have decimated its economy.

Unfortunately, they aren’t able to inject stimulus and bail out their declining housing market because in doing so, their Yuan would collapse in value even further.

So China needs the US to ease and weaken the dollar before acting.

The US is playing hard ball and has been able to justify a more restrictive policy because inflation has been a little sticky and the jobs market continues to defy expectations with unpredictable resilience.

This gives incoming president Trump and his regime leverage over China - which they may use to negotiate a deal over Taiwan, Russia, the Panama Canal, or any number of geopolitical interests.

The strong dollar and high rates presents challenges for the US domestically as well, as it slows economic growth, depresses exports, and causes pain in the real estate market, so we expect the end of the dollar strength is near.

The dollar also surged in the run up to Trump’s first inauguration before plummeting throughout his first year. We expect a similar setup this time.

DXY ( US Dollar Index)

Musk: LLMs Are Running Out Of Data

Synopsis:

As AI models face an impending shortage of real, human-generated data, tech companies are turning to synthetic data—algorithmically generated datasets—to train their systems. While synthetic data offers a cost-effective, scalable alternative, over-reliance on it risks deteriorating AI quality through "data collapse" and loss of nuance. Robust global standards and human oversight are essential to ensure synthetic data enhances AI without undermining its accuracy or reliability.

The Details:

What’s Happening:

Elon Musk and other industry leaders warn that the supply of real data for AI training is running out, with estimates suggesting exhaustion within 2–8 years.

Synthetic data, generated by algorithms, is emerging as a solution. Unlike real data, it is unlimited and faster to produce, sidestepping privacy and ethical issues tied to personal information.

Benefits of Synthetic Data:

Cost-Efficient: Requires less human effort for collection and preparation.

Privacy-Friendly: Avoids exposure of sensitive personal data.

Unlimited Supply: Can meet the growing demands of AI development.

Risks and Challenges:

Data Collapse: Over-reliance on synthetic data may lead to declining AI quality, with errors and "hallucinations" compounding across systems.

Loss of Nuance: Synthetic data often lacks the diversity and contextual richness of real datasets, potentially leading to oversimplified outputs.

Error Propagation: Mistakes in synthetic datasets, like spelling errors, can perpetuate and spread across AI systems.

Key Use Cases:

Training Models: From generative AI like ChatGPT to image tools like DALL-E, synthetic data is increasingly used to supplement human-created content.

Sensitive Fields: Particularly valuable in healthcare, where privacy concerns limit access to real-world datasets.

Future Outlook:

By 2030, synthetic data is projected to become the primary data source for AI, according to Gartner.

Why It Matters:

AI Quality and Reliability:

The effectiveness of future AI depends on the quality of its training data. Synthetic data must meet rigorous standards to prevent a decline in model performance.

Without careful oversight, AI risks becoming less accurate and trustworthy, reducing its utility across industries.

Opportunities for Innovation:

Synthetic data, when validated and combined with real data, could enhance AI models by offering diverse scenarios or addressing biases in human datasets.

Advanced tracking and auditing systems could bolster synthetic data’s reliability, creating new markets for AI auditing tools and standards.

Need for Regulation:

Global bodies like the ISO or United Nations ITU should establish frameworks for tracking, validating, and ensuring the quality of synthetic data in AI training.

Key Takeaways:

Synthetic data offers scalability and cost savings but carries risks of quality degradation and oversimplification.

Robust global standards for tracking and validating data are critical to ensuring synthetic datasets supplement real data without compromising AI performance.

Investment Watch: The rise of synthetic data could drive demand for auditing technologies and regulatory compliance solutions.

Macro Implication: Properly managed, synthetic data could fuel the next wave of AI development, but mismanagement risks undermining trust in the entire ecosystem.

Need a personal assistant? We do too, that’s why we use AI.

Ready to embrace a new era of task delegation?

HubSpot’s highly anticipated AI Task Delegation Playbook is your key to supercharging your productivity and saving precious time.

Learn how to integrate AI into your own processes, allowing you to optimize your time and resources, while maximizing your output with ease.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

Monday November 4 2024: We haven’t updated the portfolio below, but we’re buying AI memecoin GOAT at its current $520m valuation as the fastest horse in a broad crypto rally post-election.

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.