GM and BRRR.

The 109-year old “Big Three” ratings agency Fitch Ratings downgraded the United States’ credit rating from “AAA” to “AA+” yesterday afternoon, marking only the 2nd time in history a major ratings agency has downgraded the US.

Fitch cites "an erosion of governance” and “rising deficits” as two of its main reasons, pointing out that the US’ 113% (and rising) debt-to-GDP ratio is far higher than the 33% median ratio found in the 9 countries it still rates as “AAA”.

It’s a symbolic move that may impact the US’ ability to borrow on the margins, but what’s revealing is the dismissal and visceral reaction coming from government officials and the financial media in reaction.

Here’s a sampling:

Why the outrage, sweeping dismissal, and refusal to give any credence to the reasons for the downgrade itself? Because the story cuts too close to the bone.

The belief in the US and the US’ ability to pay its debts without hyper-inflating the currency is the entire game, which brings me to my final point: there is a life raft that you can use to peacefully protest and opt out of the system. That life raft is bitcoin.

It’s an unconfiscatable, uncensorable, unprintable, limited-supply store of value backed and protected by the most powerful network of compute power in the world.

No other asset is built this way. If you haven’t gone down the rabbit hole to understand bitcoin, I highly recommend it.

Today’s email is brought to you by the AI Tool Report. It’s an amazing free resource to help you stay on top of the tech world with the most impactful stories.

Please consider subscribing and opening their emails - it’ll support us at The BRRR. 👇

What Else I’m Reading

The AI Tool Report: Leverage AI for productivity. Leverage AI for creativity. Leverage AI so the robots don’t replace you. This newsletter brings the best AI Tools to your inbox. Here’s your link to subscribe for free.

Macro News

U.S. Loses Top-Notch Credit Rating

Fitch peeled yet another layer off America's fiscal credibility on Tuesday by downgrading U.S. debt one notch from AAA to AA+, making it the second major agency after S&P to strip the world's largest economy of its supposedly pristine top-tier credit rating.

Fitch raised concerns about substantially wider projected budget deficits, forecast to balloon from 3.7% of GDP in 2022 to a bloated 6.3% in 2023, as well as growing debt burdens now swelling past $31 trillion. For now, markets remain relatively unfazed, but the move casts a shadow over the trajectory of America's deficits and its debt-to-GDP ratio on track to hit 106% this year, flagging worries about the country's long-term fiscal health.

Blemished Reputation: The Fitch downgrade means the U.S. has now lost its AAA crown from 2 out of the 3 major rating agencies since S&P first knocked the country down in 2011 during a previous debt ceiling standoff. This latest move underscores eroding confidence in America's fiscal management and its ability to maintain top-tier creditworthiness.

Market Reaction: The downgrade triggered a sea of red across nearly all asset classes as equities, commodities, and bonds have sold off. Bitcoin curiously surged 3% on the announcement, but has since retraced more than half of the gain.

Deficit Quagmire: Fitch cited ballooning projections of near-record budget deficits potentially reaching $1.4 trillion this fiscal year, representing over 6% of U.S. GDP. This highlights America's increasingly precarious long-term fiscal condition and debt trajectory, despite the resilience of the economy and markets in the near-term. The downgrade signals mounting concerns over the unsustainable path of widening deficits.

Crypto News

Coinbase is set to report its Q2 2022 earnings on August 4th. Analysts will be watching for updates on trading volumes, revenue diversification, international expansion, and regulatory challenges. The company is set to report more revenue from sources not related to trading fees than trading fees for the first time.

Volumes Down: Trading volumes are expected to be low, with analysts estimating Coinbase's lowest quarterly volumes since going public. A higher take rate could buoy trading revenues.

Diversified Revenue: Subscription and services revenue has grown steadily, reaching $164 million in Q1. This includes Coinbase One fees and institutional services.

International Expansion: Coinbase International, its new Bermuda-based derivatives exchange, saw $1.96 billion in volume in July across BTC and ETH futures. But building offshore will take time.

Legal Bills: Legal costs from battles with the SEC and state regulators could top $100 million. A proposed stablecoin amendment in the 2024 NDAA could also impact interest revenue from USDC.

Today’s Reader Poll

Vote and leave a comment - we’ll feature the top comment tomorrow!

Will Bitcoin outperform the Nasdaq over the next 10 years?

AI Art of The Day

Janet Yellen comes out ready to fight Fitch after the ratings agency downgraded the US’ credit rating.

The BRRR’s Portfolio Update

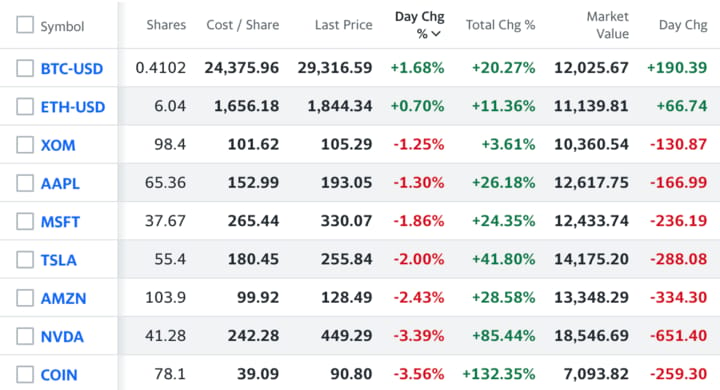

All goes down, minus crypto, following recent downgrade news.

On Watchlist:

$AMD: NVDA’s strongest competitor

$ASML: They make the machines that make AI machines

$ISRG: Robot Surgeons

$META: Sleeper in AI race and ad biz is proving resilient

$OPRA: Growing web-browsing solution

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.