random

GM and BRRR.

This morning we are watching markets closely anticipate the Commerce Department’s report on first-quarter GDP for this year, along with everyone else in the financial world.

Zoomed out a bit for a larger stock market recap of this week and this year.

Meanwhile, Fed officials seem to be playing a game of telephone as they cross wires about wage increases, notably how to maintain any semblance of control over inflation. Just need a little bit more QE, right?

Here’s what we brrr’d today:

Wall Street Week: Where Losses Are Wins and Wins Are Losses

Fed officials find common ground: skepticism about wage gains fueling inflation

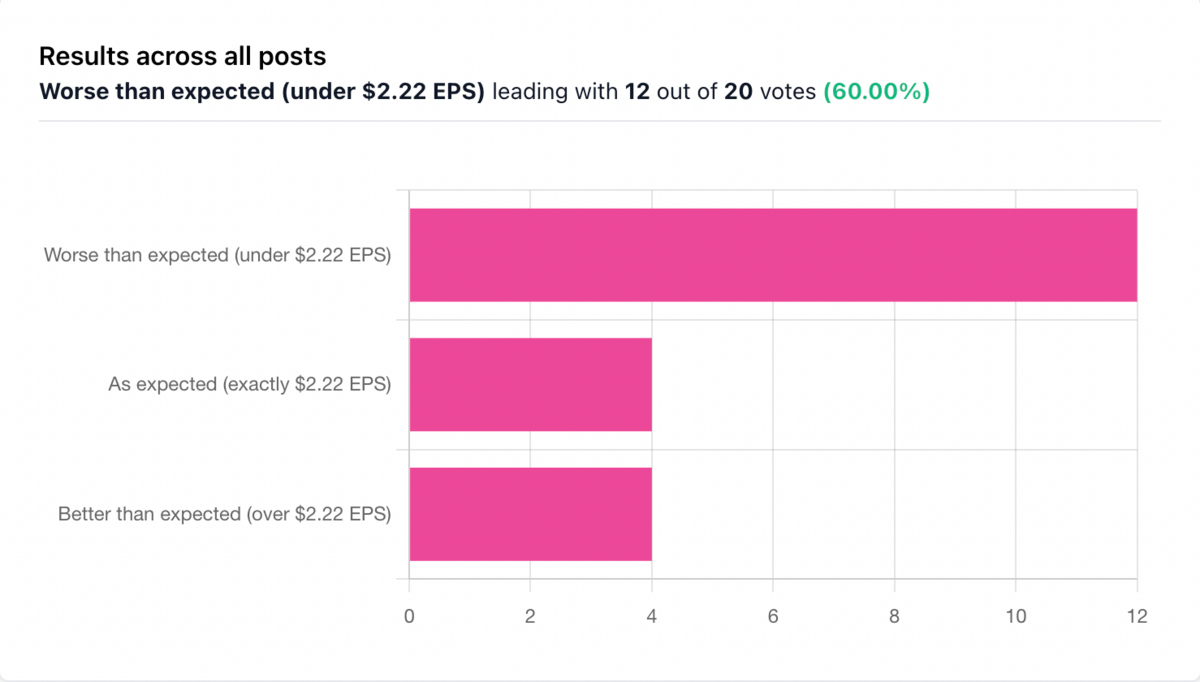

Prediction Contest Update

Microsoft’s smashed earnings reported $2.45 per share, and only 4 of you predicted it. 🥶

Next question soon.

Wall Street’s Week: Losses & Wins

Market falls for a second day: The S&P 500 fell 0.4% on Wednesday after erasing an earlier gain, coming off its worst day in a month due to concerns about U.S. banks.

Microsoft leads rally: Microsoft surged following a stronger than expected profit report, helping limit losses in the market.

This week:

S&P 500 down 1.9%: The S&P 500 is down 77.53 points, or 1.9%, for the week.

Nasdaq down 1.8%: The Nasdaq is down 218.11 points, or 1.8%, for the week.

Dow down 1.5%: The Dow is down 507.09 points, or 1.5%, for the week.

This year:

S&P 500 up 5.6%: The S&P 500 is up 216.49 points, or 5.6%, for the year.

Nasdaq up 13.3%: The Nasdaq is up 1,387.87 points, or 13.3%, for the year.

Dow up 0.5: The Dow is up 154.62 points, or 0.5%, for the year.

Fed Officials Struggle with the Foggy Crystal Ball of Wage Growth

Dovish and Hawkish: Federal Reserve officials are downplaying the significance of wage gains in driving up prices. The Labor Department’s upcoming release of the quarterly employment cost index will be closely watched by the Fed. The index is expected to have risen 1.2% in Q1, driven by minimum wage increases and catch-up pay increases.

Not so much on wages: In an interview on NPR, Chicago Fed President Austan Goolsbee argued against focusing on pay, stating that wages are not a leading indicator of prices. Minimized differences with Fed Chair Jerome Powell and emphasized that wage growth and price growth are tied together, but it is unclear which leads the other.

Big hawk plays down labor market: St Louis Fed President James Bullard has consistently played down the role of the labor market in fueling inflation, stressing the importance of inflation expectations instead. Posits a scenario where companies scale back price increases as they come to recognize they will lose customers if they don’t.

Uncertainty over growth: Wage growth has continued to moderate this year, with anecdotal evidence pointing to a downshift. The Fed’s Beige Book report shows a moderate cooling in labor markets. Economists to anticipate the employment cost index, with the wage tracker compiled by the Federal Reserve Bank of Atlanta showing salaries climbing at a faster pace in March after steady growth in the prior three months.

AI ART OF THE DAY

Jay Powell peers into his crystal ball

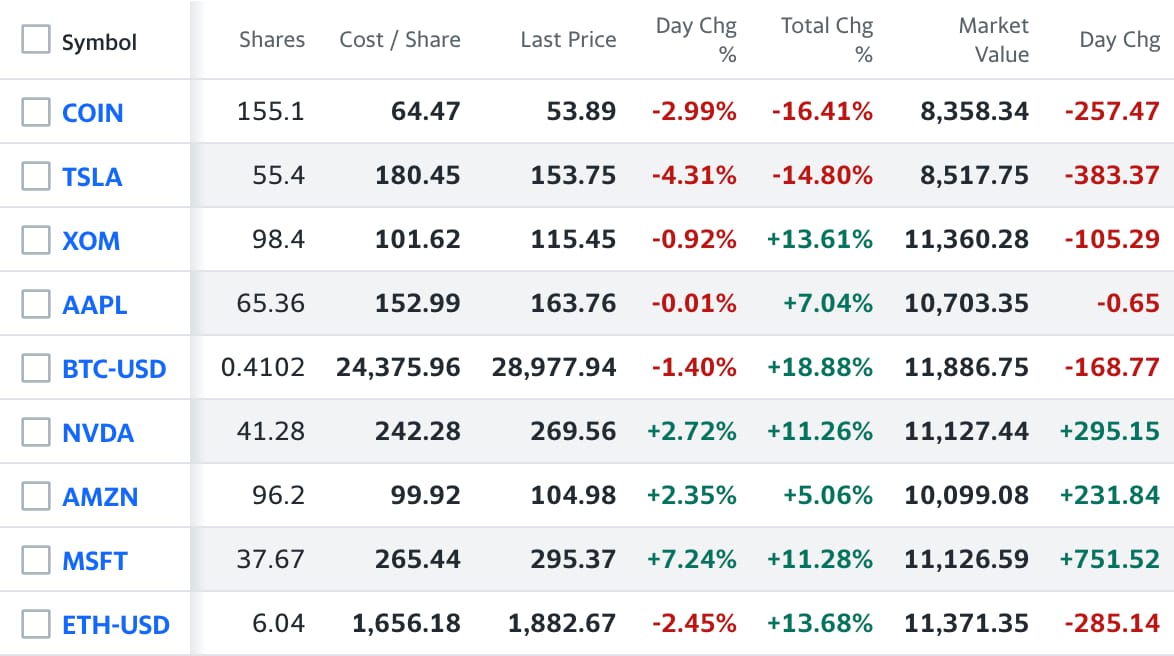

The BRRR’s Portfolio

Taking a hit, but we keep moving forward…

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Fed decisions can be a real pain in the assets. Join our Facebook group for industry insights and tricks to stay ahead of the curve. Memes for days, too.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.