TheBRRR’s Thoughts

GM.

The week is closing with a relief rally in equities after many of the best performing assets YTD rebound from recent underperformance.

The Magnificent Seven Index (tracking combined NVDA, AAPL, META, GOOG, AMZN, TSLA, MSFT, pictured below) was down by as much as 7% for the week before rebounding, currently sitting down 3.5% for the week and 3% for the month, although it is still down 12% from its all-time high set on July 10th.

Index tracking the MAG7 Stocks

Yesterday’s better-than-expected GDP report sent stocks lower, as good economic news = bad news for stocks correlation took hold.

While this morning’s mostly in-line PCE Inflation report sent stocks marginally lower, they have since rallied into the green.

Crypto has digested the mixed data fairly well as the majors have held onto recent gains. Bitcoin has been particularly resilient - after losing its multi-month range under $59K it has climbed to as high as $68k and still sits at $67.5k.

While rate cuts appear to be off the table for next week’s FOMC meeting, markets continue to price a near 100% likelihood of a rate cut in September with follow-on cuts in November and potentially December.

Macro Data Watch: PCE, GDP, Rate Cuts

WHAT HAPPENED

Core PCE Index: Inflation rose 2.6% YoY in June, unchanged from May but the slowest annual increase in over three years. The three-month annualized rate dropped to 2.3% from 2.9%.

GDP Growth: The U.S. GDP grew at an annual rate of 2.8% in Q2 2024, up from 1.4% in Q1. This growth is attributed to increases in consumer spending, inventory investment, and business investment.

Economic Scale: The U.S. GDP reached $28.63 trillion, a 1.27% increase from the previous quarter and a 5.79% increase from a year ago.

Fed's Position: The steady inflation reading suggests no rate hike in July, with a potential rate cut teed up for September.

WHY IT MATTERS

Fed's Dilemma: The steady core PCE reading gives the Fed more time to assess inflation trends before committing to a rate cut, aligning with their 2% target.

Economic Momentum: The stronger-than-expected GDP growth indicates robust economic activity, suggesting resilience despite ongoing inflationary pressures.

Economic Signals: Despite inflation being slightly above expectations, the Fed's confidence is boosted as inflation trends downwards without hampering growth.

Market Reactions: A September rate cut is priced in by the market, but any signs of accelerating inflation could delay it. The Fed's next moves are critical for market stability and investor confidence.

KEY TAKEAWAYS

Inflation Trends: Slowest rise in core PCE in over three years, steady at 2.6% YoY.

Rate Cut Speculation: Strong expectations for a September rate cut, with no move likely in July.

Market Watch: Investors are keen on Fed communications for signals on the economic outlook and policy direction.

Crypto Watch: Trump At Bitcoin Conference & ETH ETF Performance

WHAT HAPPENED

Bitcoin Conference 2024 Preview: The upcoming Bitcoin Conference in Nashville, Tennessee, from July 25-27, is generating significant buzz due to the participation of high-profile figures including Donald Trump and Senator Cynthia Lummis.

Key Attendees and Announcements: Former President Donald Trump and Senator Cynthia Lummis are expected to make significant announcements that could impact the cryptocurrency landscape.

WHY IT MATTERS

Trump’s Strategic Move: Trump is rumored to declare Bitcoin a "strategic reserve asset," positioning it as a critical component of the U.S. financial strategy. This move could elevate Bitcoin's status and potentially reshape the global economic paradigm by promoting its adoption as a reserve currency (Kriptokoin.com) (Nasdaq).

Economic and Regulatory Implications: Trump's support for Bitcoin mining and financial freedom aligns with his broader economic strategy. His advocacy could attract significant investment into the U.S. Bitcoin industry, enhancing its global competitiveness and fostering innovation in the sector (CoinMarketCap).

Market Impact: Such high-profile endorsements and policy proposals are likely to influence market sentiment, potentially driving up Bitcoin prices and attracting new investors. The designation of Bitcoin as a strategic reserve could also bolster its legitimacy and stability (Kriptokoin.com).

KEY POINTS

Trump’s Agenda: Expected to emphasize Bitcoin mining, financial freedom, and the strategic importance of Bitcoin in countering economic rivals like China and Russia. This aligns with his broader economic and geopolitical goals (Nasdaq).

ETH ETF Update

Ethereum ETF Outflows: Ethereum ETFs experienced a net outflow of $152.4M on July 25, 2024, despite inflows from funds like BlackRock’s ETHA ($70.9M) and Fidelity’s FETH ($34.3M), driven primarily by outflows from Grayscale’s ETHE (-$346.2M) (CryptoNews).

Bitcoin ETF Inflows: On the same day, Bitcoin ETFs saw a net inflow of $31.1M, with BlackRock’s IBIT gaining $70.7M, partially offset by Grayscale’s GBTC losing $39.6M, showcasing stronger investor confidence in Bitcoin compared to Ethereum.

Market Impact: The differing trends resulted in Bitcoin reaching a 3-month high in market dominance at 56.6%, while the ETHBTC ratio fell nearly 10% to 0.048 BTC, reflecting Ethereum’s relative underperformance.

Steal our best value stock ideas.

PayPal, Disney, and Nike all dropped 50-80% recently from all-time highs.

Are they undervalued? Can they turn around? What’s next? You don’t have time to track every stock, but should you be forced to miss all the best opportunities?

That’s why we scour hundreds of value stock ideas for you. Whenever we find something interesting, we send it straight to your inbox.

Subscribe free to Value Investor Daily with one click so you never miss out on our research again.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Most Recently Revealed Trade:

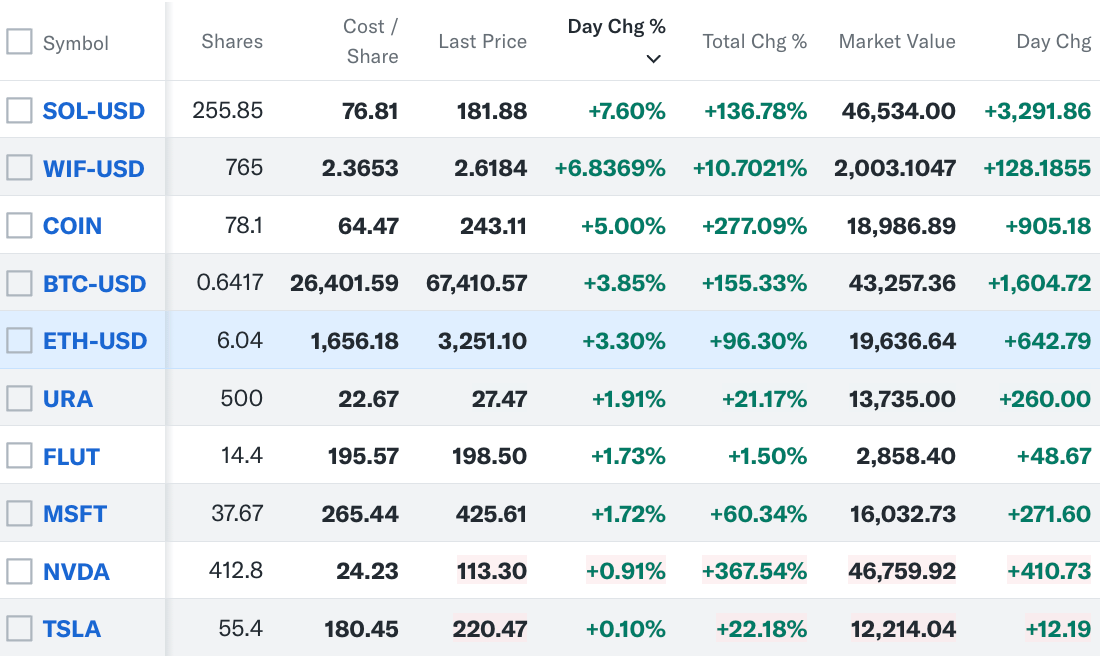

Wednesday April 17 2024: We bought more Solana at $131 and added Solana’s top memecoin WIF at $2.36 on the heels of a leverage wipeout dip after the WW3 scare.

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

Portfolio Notes

June 12: These assets all look great for continuation higher.

We are considering moving on from Tesla as it has lagged the rest of our portfolio badly and doesn’t have an obvious catalyst. We’ll monitor and let you know if we decide to move on.

Older Notes

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll