Editor’s Note: We started a daily podcast version of the newsletter. If you’d like to subscribe, it’s called Money Printer Go BRRR Podcast across all the podcast players. Here are the links to it on Spotify and Apple.

GM and BRRR. The corporate press is billing yesterday’s FOMC meeting as a “Hawkish Pause”. So what the hell is a hawkish pause? Well…

Jay Powell and the FOMC announced they would leave interest rates unchanged at 5.00%-5.25%, as expected. However in their projections for interest rates through the end of the year, FOMC members surprised markets with higher-than-expected terminal rate expectations. Their base-case now includes two additional 0.25% rate hikes before the end of the year.

Historically, there is no precedence for the FOMC to pause and later continue hiking rates, so despite the FOMC’s strong hawkish posturing, markets don’t yet fully believe them.

That’s your hawkish pause.

However after initially reacting negatively to the totality of the news, equities have reverse and we’re seeing strength across the S&P500 and Nasdaq on Thursday morning.

Two of 2023’s biggest winners and BRRR portfolio holdings NVDA and MSFT are up 5% and 3% respectively from pre-FOMC levels. The big-tech AI surge continues with little regard for the macro environment.

Here’s what we’ve BRRR’d:

Hawkish Fever Sweeps the Globe: Central Banks Flex Their Monetary Muscles

AMD's Optimism Shines as They Aim to Disrupt Nvidia's AI Dominance

Hawkish Fever Sweeps the Globe: Central Banks Flex Their Monetary Muscles

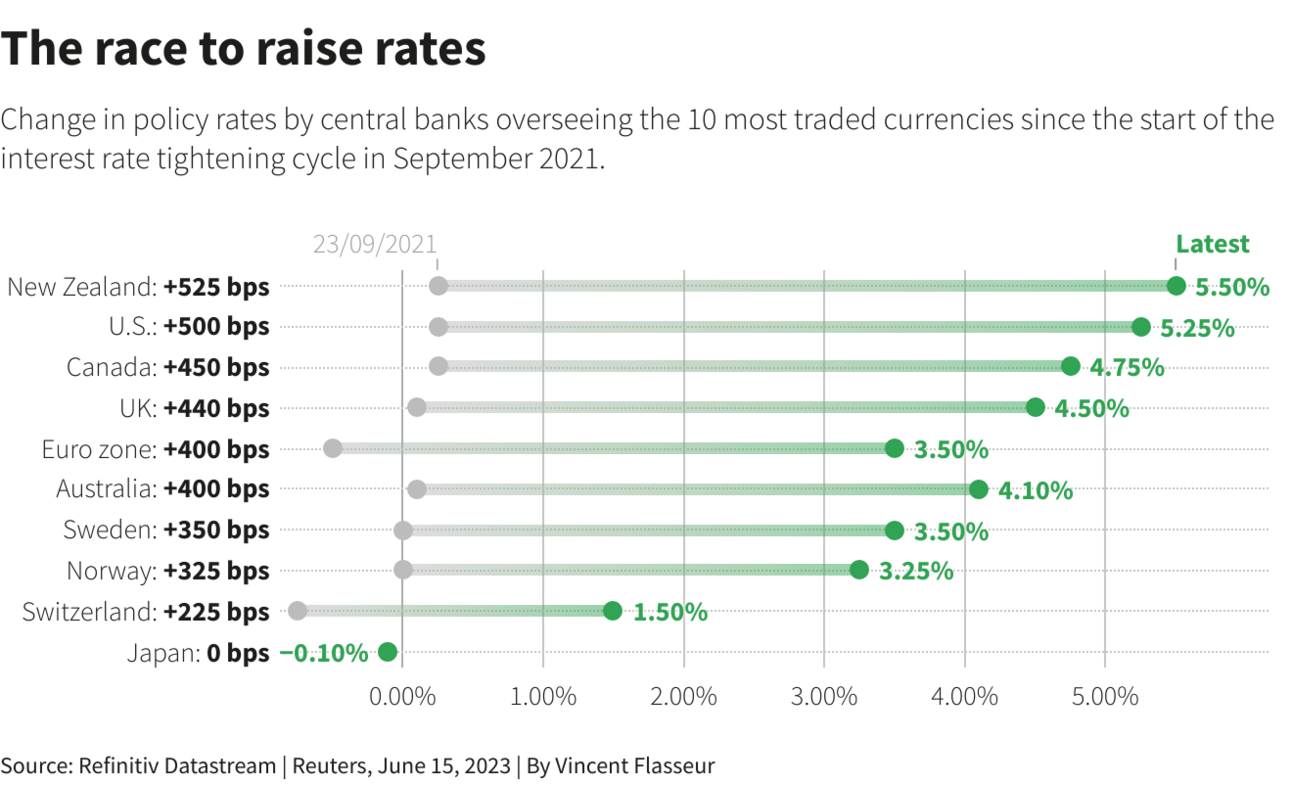

Central banks remain hawkish: Despite easing inflation, major central banks continue to maintain a hawkish stance, signaling potential further rate hikes. Nine developed economies have collectively raised rates by 3,615 basis points in this cycle, indicating a tightening monetary policy.

Federal Reserve’s temporary pause: The Federal Reserve paused its aggressive rate hike series, keeping the main funds rate between 5% and 5.25%. Two more 25-basis point hikes are projected for this year, as the U.S. economy outperforms expectations and inflation declines slowly.

European Central Bank (ECB) hikes rates: The ECB raised rates by 25 basis points, reaching a 22-year high deposit rate of 3.5%. Inflation is expected to stay above the 2% target through 2025, prompting hints of potential further rate hikes by the ECB.

RBNZ signals end of tightening cycle: The Reserve Bank of New Zealand (RBNZ) raised its cash rate to 5.5%, the highest level in 14 years. The RBNZ surprised markets by indicating that rates would not go above this level, suggesting the end of its tightening cycle.

Bank of Japan maintains dovish stance: The Bank of Japan (BOJ) remains the world's most dovish central bank, keeping policy ultra-loose. Although inflation may exceed BOJ's forecasts, a sudden rate hike is highly unlikely, as the BOJ maintains low rates and yield curve control.

AMD's Optimism Shines as They Aim to Disrupt Nvidia's AI Dominance

AMD unveils "superchip": AMD showcased a new "superchip" that combines a central processor, graphics processor, and memory in a single chip packaging. This innovation aims to enhance high-performance computing in data centers, offering improved processing power and efficiency.

Introduces AI-focused data center accelerator: AMD announced a graphics-processor based "accelerator" designed for artificial intelligence applications in data centers. This move positions AMD in direct competition with Nvidia, a leading player in the AI segment of computing.

Challenge to Nvidia's market presence: Nvidia holds a strong head start in the AI market, having invested significant time in developing underlying software code and essential technologies. AMD's entry into the market might face difficulties in catching up to Nvidia's established position.

AMD's data-center accelerator delayed: The chip is expected to start sampling with major customers in the third quarter of this year, with production commencing in the fourth quarter. Volume shipments may not begin until mid-2024, which poses a challenge as Nvidia's competing product arrived approximately 18 months earlier.

Growth limited compared to Nvidia: AMD's data-center segment revenue experienced no year-over-year growth in the March quarter, while it saw 42% growth in the previous December period. Analysts project a 7% decline in the current quarter, with expectations of growth rebounding in the second half of the year. In contrast, Nvidia's data-center sales are expected to grow by 91% in its fiscal year ending in January, overshadowing AMD's projected 11% rise for the full year.

AI ART OF THE DAY

Jay Pow continues to be a hawk leading the Fed.

The BRRR’s Portfolio

Regulatory environment has killed crypto performance. Big Tech holding us up. Tempted to trim TSLA, NVDA and MSFT gains for more BTC, ETH and COIN right here, but will wait for some crypto strength first.

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.