TheBRRR’s Thoughts

GM. The Japanese Yen took a hit in premarket trading today, experiencing rare levels of high volatility against the dollar.

The Yen-to-USD ratio is now 160:1, far above the 105:1 ratio seen as recently as January 2021 and the 125:1 ratio seen in January 2023.

The Japanese central bank is expected to intervene by selling dollars for yen this week, but no one knows the magnitude/size of the action they’ll take.

There is speculation that the magnitude of the move and potential trade imbalance a sustained weakening of the Yen would imply limits the amount of tightening and dollar strength the US treasury and Fed can drive from here.

Today we’re covering Tesla’s breakthrough in China announced this morning.

We’re also previewing today’s 3pm announcement from the US Treasury. The implications of their announced strategy and debt rollover plan has a lot of potential to move risk assets in either direction.

Tesla Jumps 12% After Securing Key Regulatory and Partnership Advancements in China

WHAT HAPPENED:

Tesla's stock saw a significant 12% increase following new regulatory approvals and strategic partnerships in China, facilitating the expanded rollout of its Full Self-Driving (FSD) technology in the world's largest EV market.

Elon Musk met with China’s premier, Li Qiang, underscoring high-level political support for Tesla’s initiatives. Premier Li has been a longstanding ally, instrumental in Tesla’s expansion efforts in China.

Tesla received specific regulatory nods from the China Association of Automobile Manufacturers, addressing data security for its vehicles, including the popular Model 3 and Model Y.

WHY IT MATTERS:

Strategic Partnerships for Advanced Capabilities: A crucial deal with Baidu grants Tesla access to high-resolution mapping data, essential for the operational effectiveness of FSD on Chinese roads. This partnership marks a significant upgrade from previous basic navigation integrations.

Handling of Data Security Concerns: Tesla's operation of a local data center in Shanghai, managing extensive vehicle data, aligns with China’s stringent data security regulations. This setup helps Tesla maintain compliance and operational integrity within China.

Competitive Dynamics in EV Market: The regulatory advancements and partnerships not only bolster Tesla’s position in China but also come at a time when local competitors like BYD and Nio are intensifying competition. Tesla's continued focus on enhancing its FSD technology could provide a competitive edge in innovation.

Safety and Market Perception: Broader discussions on the safety of self-driving technologies in both the U.S. and China, along with Tesla’s proactive compliance measures, are crucial in shaping market acceptance and regulatory approaches in pivotal markets.

US Treasury To Make Key Announcement at 3pm Today

U.S. Treasury's Strategic Financial Moves:

Treasury Actions: The U.S. Treasury, led by Secretary Janet Yellen, is poised to make significant refinancing announcements that could potentially inject a substantial amount of liquidity into the market. The expected actions include reducing long-term treasury issuance in favor of more short-term bills and possibly drawing down the Treasury General Account (TGA).

Specific Plans: According to various reports, the Treasury might stop issuing longer-term treasuries altogether or shift more borrowing towards T-bills. These actions aim to provide liquidity by affecting the reverse repurchase agreement markets and directly injecting funds into the economy.

Timing and Context: These moves are strategically timed before the Federal Open Market Committee’s policy announcement, suggesting a coordinated approach to influence market conditions favorably.

Potential Market Implications:

Impact on Cryptocurrencies: Speculations are rife that these treasury actions could lead to a significant rally in cryptocurrency markets, particularly Bitcoin. Historical patterns and current market conditions suggest that liquidity injections from the Treasury could re-accelerate the crypto bull market.

Broader Financial Market Effects: Beyond cryptocurrencies, the expected treasury actions are likely to have a broad impact on financial markets. Reduced bond issuance can lower yields and encourage risk-taking by making risk-free assets less attractive. This could benefit stocks and lower-rated corporate bonds.

Economic and Political Overtones: With substantial funds set to be disbursed into the financial system, these actions might also be aimed at bolstering the economy ahead of upcoming elections. The timing and nature of the Treasury’s moves could be seen as an effort to stabilize or stimulate economic growth in a politically sensitive period.

Conclusion:

Today's focus on the U.S. Treasury's impending actions highlights a crucial aspect of how governmental financial strategies are intricately linked to broader economic and market dynamics. These actions, while primarily financial, carry significant economic and political implications, potentially shaping market sentiments and economic policies in the near term.

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $3/month or $14.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Here’s the link to The BRRR Technical Analysis Chatbot - let me know what you think!

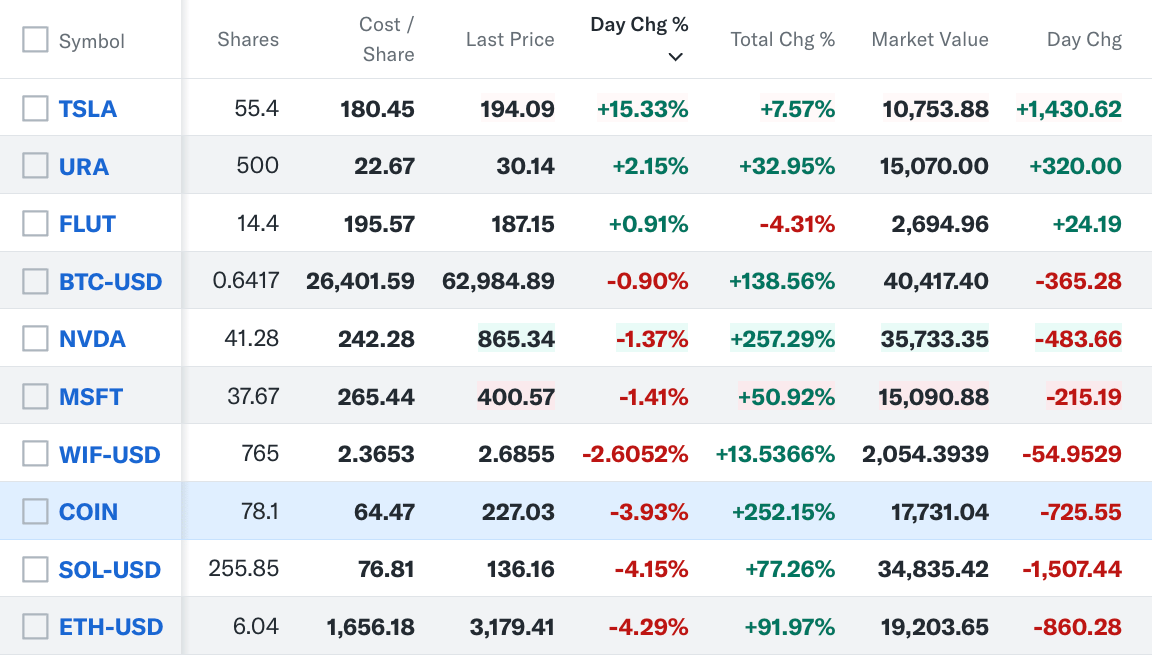

Portfolio

Notes

Wednesday April 17 2024: We bought more Solana and added Solana’s top memecoin WIF on the heels of a leverage wipeout dip after the WW3 scare.

Wednesday, April 3, 2024: We haven’t deployed the cash yet, but are eyeing exposure to a few assets including META and PLTR.

Monday, March 11, 2024: We sold Apple this morning. The newsletter held the stock from inception a year ago for a meager 12% gain.

The company has lost its magic evident by complacent iPhone releases, lack of a coherent vision for AI integration and punitive & anti-competitive App Store policies.

We believe the stock will move in-line with the broader Nasdaq going forward.

We’ll sit on the cash for now, but plan to redeploy it quickly.

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.ll