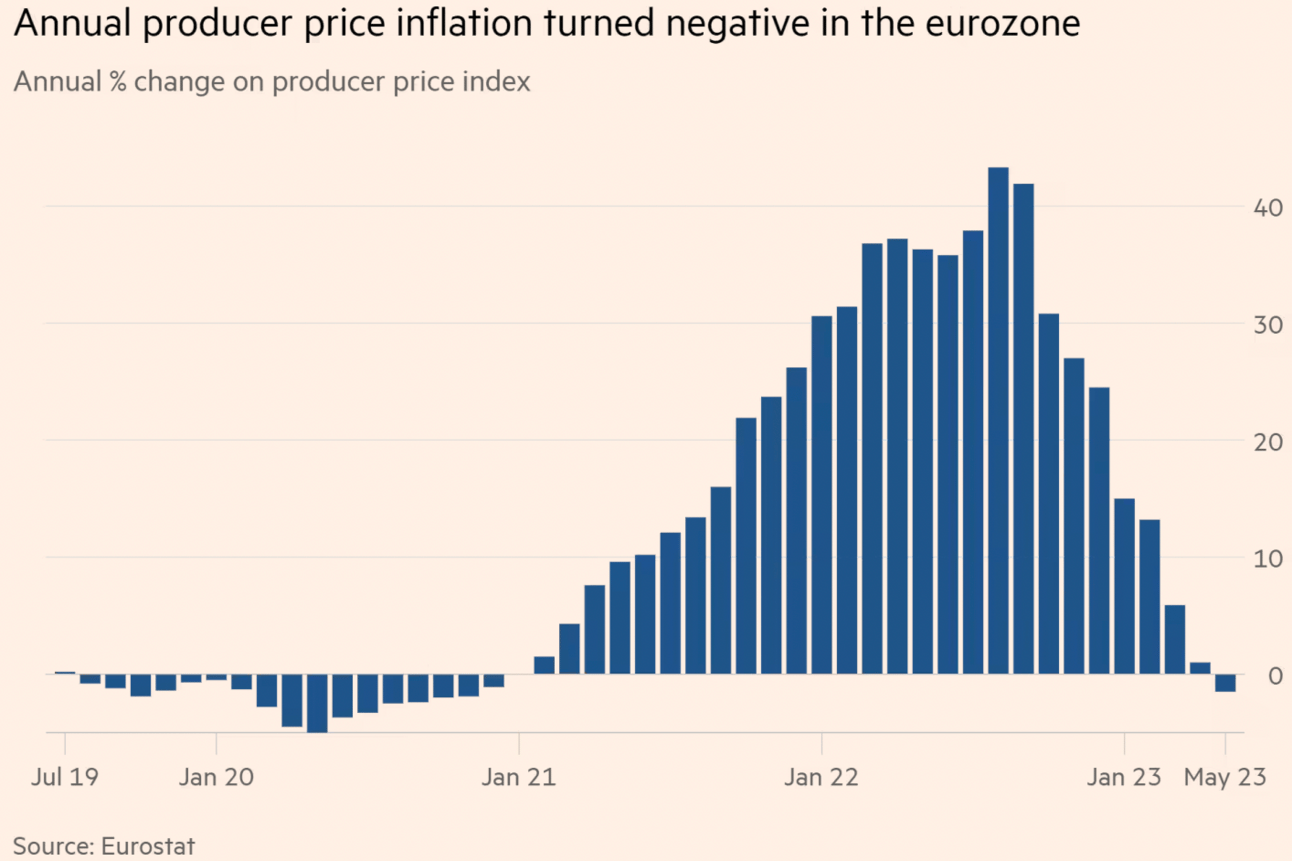

Producer prices down y/y

GM and BRRR.

In macro news, inflation continues to subside across the globe. For the first time since December 2020, the Eurozone has seen its key measure of inflation fall into negative territory, with factory gate prices dropping by 1.5% in the year to May. This shift indicates that the surge in prices that previously burdened businesses and consumers is receding.

This is in-line with The BRRR’s expectations, as the interest rate hikes have effectively squashed demand and damaged worldwide confidence in the economy. Because of this, we expect central banks to pivot and begin cutting interest rates by the end of the year. (read more)

Markets are flat on the deflation news, as the US waits notes and minutes from The Fed’s mid-June meeting. The Fed decided to leave interest rates unchanged in June, but did hint at additional rate hikes later this quarter, and the minutes should reveal more of their thinking.

Today we’re covering bitcoin’s uncorrelated price performance and the ongoing feud between the Chinese government and Mark Zuckerberg.

While Zuck has expressed desire to sell his VR headsets to the Chinese markets, he has been critical of the CCP in the past and they may place vindictive restrictions on Meta’s ability to engage in commerce in mainland China.

When we last polled The BRRR audience about the ETF, 100% voted they thought the ETF would get approved. In light of today’s news, has your opinion changed?

Will The Fed cut Interest Rates at least once before the end of 2023?

AI: The Money Robots

Chinese State Media Disses Zuck

Chinese Media Criticizes Zuckerberg: Chinese state media has criticized Meta CEO Mark Zuckerberg for his reported plans to sell Quest headsets in mainland China. The media outlet accuses Zuckerberg of "shooting himself in the foot" with this effort, given his previous criticism of Chinese industrial espionage and specific China-based companies like TikTok, which according to the outlet, amounts to self-sabotage of his business prospects in China.

Zuckerberg's Relationship with China: Zuckerberg has previously criticized the Chinese government for stealing technology from American companies, a stance that stands out from other tech CEOs. His perceived adversarial stance towards Chinese companies and espionage efforts has reportedly affected Meta's efforts to establish a presence in the Chinese market, despite ongoing discussions with Tencent to sell Meta’s Quest headsets within mainland China.

Contrast with Other Tech CEOs: The Chinese state media editorial points out the contrasting approaches of Apple CEO Tim Cook and Tesla CEO Elon Musk, who have had positive engagement with the Chinese regime and markets. In contrast, Zuckerberg has not made significant inroads in China. The editorial also notes that other tech companies, like Google, have withdrawn from mainland China, while Microsoft plans to sunset its LinkedIn-like app in the country.

Our take: Meta’s been on a tear this year, tripling off the bottom it set at the end of 2022. It may cool off in the near-term, but we like the stock over a long time horizon as its advertising business is still incredibly durable.

Crypto: Digital Gold Rush

Bitcoin Not Currently Correlated to US Stocks

Bitcoin Decoupling from Traditional Markets: According to Block Scholes, a crypto derivatives analytics firm, the 90-day rolling correlation of changes in Bitcoin's spot price to changes in the Nasdaq and S&P 500 has declined to near zero. This suggests that Bitcoin's performance is now largely independent from the sentiment in U.S. stock markets, reinforcing the unique value proposition of Bitcoin and its role as a non-correlated asset within a diversified portfolio.

Impact of ETF Filings on Bitcoin: The wave of recent spot Bitcoin exchange-traded fund (ETF) filings by big-name firms like BlackRock, Fidelity, WisdomTree, VanEck, and Invesco have brought a new wave of optimism to the crypto market. In fact, since BlackRock's filing on June 15, Bitcoin has yielded a return of 25%, irrespective of the flat performance of U.S. stock indices, showcasing the potential for the crypto market to thrive independently of traditional finance.

Increased Interest in Bitcoin ETPs Post-ETF Filings: In a bullish signal for Bitcoin, the investor interest in exchange-traded products (ETPs) has surged since the BlackRock announcement on June 15. Bitcoin ETPs globally saw inflows of 13,822 BTC in June, with strong inflows seen across Canadian and European spot ETPs and U.S. futures ETFs. This further validates Bitcoin's standing as an asset class and illustrates its potential for mainstream adoption, outperforming traditional banking systems.

Our take: Decoupling from equities is a good sign for BTC as it indicates new narratives are forming around the asset.

AI Art of The Day

The BRRR’s Portfolio Update

Cooling today as profit-taking ensues. We are considering shifting half of our COIN exposure to AAPL after the recent run-up.

On Watchlist:

$AMD: NVDA’s strongest competitor

$ASML: They make the machines that make AI machines

$ADBE: Creativity & productivity software

$ISRG: Robot Surgeons

$OPRA: Growing web-browsing solution

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.