Happy Friday vibes and BRRR.

In today’s episode of “bad news is good news”, markets are rising in reaction to new disappointing payroll data.

The Bureau of Labor Statistics reported that the June payrolls were significantly lower than expected at 209K, a substantial decrease from the previous month's 306K (revised down from 339K), and the lowest figure since December 2020. This marks the first time the series has missed economist expectations since April 2022, ending a 13-month streak of surpassing predictions. Additionally, revisions to the April and May payrolls resulted in a combined total that was 110K lower than initially reported.

The major contributors to the 209K figure were the government sector, which added 60,000 jobs in June, and healthcare, which added 41,000 jobs.

Despite weaker-than-expected headline job data, the low unemployment rate and strong wage growth suggest that the Federal Reserve is still on track for a July rate hike.

Overall, this report presents a mixed enough picture that the Fed might proceed with a modest 25 basis point rate increase, but doesn't necessitate significant adjustments beyond that.

As we zoomed into specific tech and crypto stories, we’re highlighting the launch of Zuck’s new app Threads and further analysis of BlackRock’s pivot on bitcoin.

Threads has launched with much fanfare - amplified and championed by the many of the journos that despise Elon Musk’s vision for Twitter. We’ll see if it has staying power or if it devolves into an echo-chamber.

And finally - 75% of our readers voted YES in yesterday’s poll - indicating they expect the Fed to cut interest rates this year. Where do you stand? Vote and leave a comment after voting - I’ll highlight the best comment in the next edition. ⬇️

Will The Fed cut Interest Rates at least once before the end of 2023?

AI: The Money Robots

Threads Unravels Twitter's Cool: Meta's Latest Move Ruffles Feathers

Meta's Threads app, launched by Meta Platforms, has gained early success with over 30 million sign-ups within 24 hours, leading to advertiser interest and Twitter's accusation of intellectual property theft. The app's connection to Meta's ecosystem and access to user data from platforms like Instagram and Facebook make it attractive to advertisers. However, it remains to be seen if Threads can sustain its momentum and compete with Twitter's large user base.

Twitter Alleges Stolen Data: Twitter has accused Meta Platforms, the company behind Threads, of hiring former Twitter employees and assigning them to work on the app. A letter from a Twitter lawyer called Threads a copycat and demanded that Meta stop using any Twitter trade secrets. However, a Meta spokesman refuted the allegations, stating that no one on the Threads engineering team is a former Twitter employee.

Threads App Surges: Despite being in its early stages, Threads has garnered significant attention and user engagement. Within 24 hours of its launch, the app gained over 30 million sign-ups, reaching the top of app store download charts and becoming a trending topic on Twitter. This initial success has attracted interest from advertisers who see the potential for Threads to become an attractive platform for targeted advertising due to its connection to Meta's ecosystem and its access to user data from platforms like Instagram and Facebook.

Potential for Advertisers: While Threads does not currently carry advertising, industry experts believe that if the platform achieves sufficient scale, it could become a lucrative advertising channel for Meta. Ad-agency executives have highlighted Threads' advantage over other platforms, as Meta already possesses valuable user insights from users' activities on Instagram, Facebook, and WhatsApp. This wealth of information allows Threads to have a head start in understanding its user base, potentially making it an appealing advertising platform in the future.

Crypto: Digital Gold Rush

BlackRock’s Bitcoin Pivot

BlackRock CEO Larry Fink, who once dismissed Bitcoin as an "index of money laundering," has now endorsed it as a financial revolution. This shift in perspective comes as BlackRock's clients, including large-scale investors like insurance companies, pension funds, and high-net-worth investors, increasingly seek alternatives to hedge against debasement.

Shift in Perception: Fink's endorsement marks a stark contrast from his 2017 stance, demonstrating how traditional financial giants are gradually embracing digital assets. He emphasized Bitcoin's role as an international asset, independent of any single currency, offering an alternative for investors amidst inflation and geopolitical turmoil. Fink’s endorsement reduces the perceived career and reputational risk for legacy financial managers to advocating for bitcoin.

Economic Instability and Bitcoin as a Hedge: BlackRock's clients are becoming increasingly concerned about economic stability due to rampant inflation, drastic interest rate hikes, and bank failures. These concerns have ignited discussions about protecting wealth, leading to the reconsideration of Bitcoin, alongside traditional options like gold.

Client Demand Driving Change: The adoption of Bitcoin by BlackRock has been largely client-driven. The firm, which manages $10 trillion in assets, attributes its success to listening to its clients. As Bitcoin is increasingly seen as a potential hedge against inflation and geopolitical risks, more clients are expressing interest, leading BlackRock to take the digital currency more seriously.

AI Art of The Day

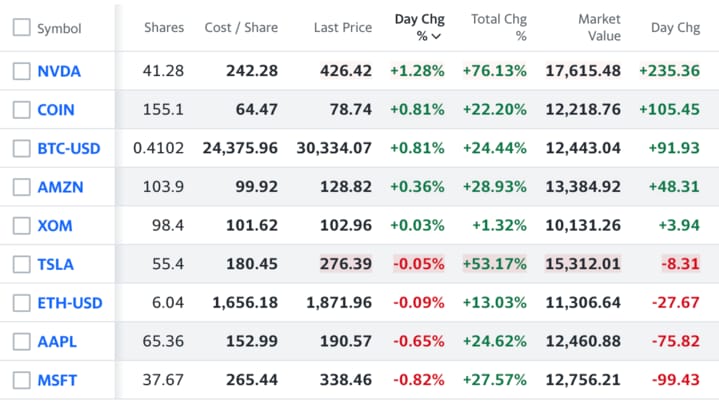

The BRRR’s Portfolio Update

$OPRA is up 28% since we first wrote about it and added it to the watchlist in late June.

On Watchlist:

$AMD: NVDA’s strongest competitor

$ASML: They make the machines that make AI machines

$ADBE: Creativity & productivity software

$ISRG: Robot Surgeons

$OPRA: Growing web-browsing solution

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.