GM and BRRR.

Stocks are inching higher on this beautiful Monday despite weaker-than-expected economic data out of China.

Crypto, despite the favorable ruling in the Ripple Labs vs SEC case, has hesitated to follow through on its initial impulse higher.

While Ripple’s XRP token remains 60% higher than it was prior to the ruling, other cryptos that should have seen correlated price increases have sputtered out. Ether had surged as much as 8% following the news, but has since fallen back to where it started.

We’re not quite sure what to make of the price action, so we’re cautious until we see some sustained momentum.

In other weekend news, the New York Post reported that Janet Yellen ate potentially psychedelic mushrooms while in China, potentially explaining her incessant cow-towing and bowing episode when meeting Chinese officials during her trip.

Today’s news coverage goes deep into two stories:

1) AI Agents - autonomous productivity on-demand

2) Crypto Pauses Despite Bullish XRP News

Today’s email is brought to you by the TLDR Newsletter. It’s an amazing free resource to help you stay on top of the tech world with the most impactful stories.

Please consider subscribing and opening their emails - it’ll support us at The BRRR. 👇

What Else I’m Reading

The TLDR Newsletter: Want to understand the most important trends and stories in tech in 5 minutes or less? TLDR has amassed over 1m subscribers because that’s exactly what they deliver. Here’s your link to subscribe for free.

Still reading: The AI Tool Report for specific ways to leverage AI for productivity.

AI: The Money Robots

AI Evolves: From Virtual Assistant to Autopilot

The advent of GPT-4 is sparking a new wave of AI agents that possess greater autonomy and capabilities compared to earlier virtual assistants like Siri or Alexa. These new agents or "copilots" are being developed to perform more complex tasks independently and are being backed by billions in investments from Silicon Valley. They are being envisioned as personal AI friends capable of carrying out tasks ranging from ordering food to creating investment strategies and summarizing meetings. Despite these advances, industry experts acknowledge that the technology is still a long way from the AI portrayed in science fiction, as there are still many challenges to overcome such as robust reasoning and dealing with unexpected real-world scenarios.

Innovation in AI Agents: GPT-4 has propelled the development of increasingly autonomous AI agents. While currently able to perform tasks like ordering food online and creating investment strategies, developers like Div Garg of MultiOn aim for these agents to evolve into an AI system similar to Tony Stark's Jarvis in the Iron Man movies.

Commercial Interest and Investments: AI agents have attracted significant investments, with startups like Inflection AI raising $1.3 billion and Adept raising $415 million. Tech giants Microsoft and Google's parent company, Alphabet, are also focusing their efforts on this field, indicating substantial commercial interest.

Challenges and Ethical Concerns: Despite the progress made, AI agents still face hurdles like the difficulty of executing multi-step tasks that involve complex reasoning. In addition, potential issues such as perpetuating human biases, misinformation, and the threat of autonomous agents developing and acting on their own unexpected goals underscore the need for careful regulation and supervision.

Crypto: Digital Gold Rush

Bulls, Bears, and Bitcoin: $30K Saga Continues

Bitcoin traders brace for a potential $30K loss as the cryptocurrency's price remains volatile within a narrow range, showing little signs of changing trends. BTC price continues to oscillate without a clear indication of whether bulls or bears will ultimately prevail. Despite this uncertainty, on-chain data suggests a re-accumulation phase among investors, perhaps indicative of a significant market move in the near future. Market sentiment remains neutral according to the Crypto Fear & Greed Index.

Concerns over BTC Price Stability: Bitcoin has been hovering within a narrow range since last week, causing frustration among traders. Some predict a new local low for Bitcoin given the ongoing struggle to break the range for an extended period, suggesting possible downside targets as low as $27,400.

Earnings Season and U.S. Data Releases: With a lack of significant U.S. data due this week, those hoping for a shake-up in risk assets might be disappointed. Focus turns towards tech firm earnings and jobless claims on July 20. Meanwhile, markets anticipate that the Federal Reserve will resume rate hikes, with the odds of a 0.25% hike standing at a near-unanimous 96.1% as of July 17.

Bitcoin Whales Re-emerging: On-chain data suggests a reawakening of Bitcoin whales (large investors). The UTXO Value Bands metric shows a gradual resurgence of whales in 2023 following a retreat in the latter half of 2022, a trend often associated with a bull market.

Supply Dynamics and Investor Sentiment: More of the Bitcoin supply has moved near the $30,000 mark than at any other price point, indicative of a significant interest among the investor base. Meanwhile, long-dormant supply is becoming active again, a pattern usually seen in early stages of Bitcoin bull markets. However, the Crypto Fear & Greed Index shows market sentiment at its lowest for July, pointing to a neutral stance among market participants.

Today’s Reader Poll

Vote and leave a comment - we’ll feature the top comment tomorrow!

Have you used Instagram Threads?

AI Art of The Day

The BRRR’s Portfolio Update

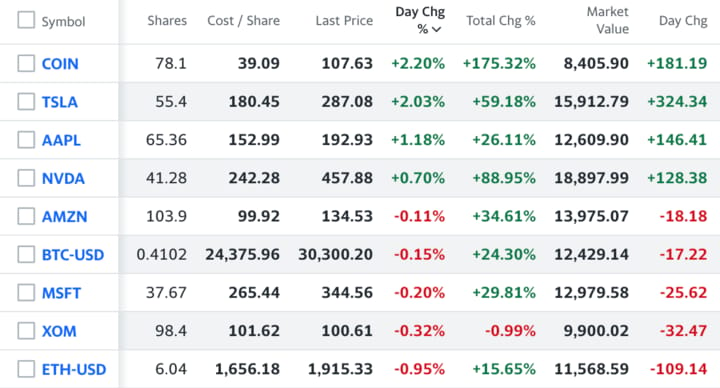

Following SEC/Ripple “effect”, Coinbase remains strong while BTC hovers in wait. Tesla likely to see some gains following Cybertruck news, so we remain hopeful.

OPRA falters a bit following last week’s mixed shelf offering, but hopes this will pave a better path towards less concentrated ownership.

On Watchlist:

$AMD: NVDA’s strongest competitor

$ASML: They make the machines that make AI machines

$ISRG: Robot Surgeons

$OPRA: Growing web-browsing solution

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Join our Facebook group to connect with the community.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.