GM and BRRR.

The hits keep coming.

While the crypto world celebrates Coinbase and Apple’s Q1 earnings by mooning new memecoins like PEPE to $1B, the broader financial system remains in a tenuous position.

This morning saw mildly positive jobs data in the form of the monthly non-farm payroll report - unemployment surprised to the downside at 3.4%, while the labor force participation rate remained low at 62.6%.

With the elevated interest rates and continued signaling from the Fed that rates shall remain high, stress continues to infiltrate the regional banking sector. Instead of solving the problem, the White House is publicly shaming short-sellers and could explore a ban on the activity, which would be a classic case of treating the symptom and not the cause.

Here’s what we brrr’d today:

Jobs Report Beats Expectations…While Changing Previous Data

Bankers to Short Sellers: We Don’t Like Your Short Shorts

BLS Report Breaks Records…With An Asterisk

Jobs Reports beats expectations (again!): The US economy added 253,000 nonfarm payroll jobs in April, much higher than the 185,000 that economists had expected, according to Bureau of Labor Statistics report. Apparently, this beats Wall Street expectations for 13-months in a row, a new record.

Plethora of Workers: The unemployment rate also dropped unexpectedly to 3.4%, the lowest level since May 1969. Lowest black unemployment on record.

Wage Growth Improves (for now): Average hourly earnings increased by 0.5% month-on-month and 4.4% year-on-year, beating economists' forecasts. Still not keeping up with inflation, though…

Feb & March Numbers Worsen: Employment gains in March were revised lower to 165,000 jobs, 71,000 fewer than previously reported. February's job gains were also revised lower, making job growth over that two-month stretch lower than previously reported by 149,000. Job gains over last six months now average 290,000, down 15% from 334k (previously reported here).

ZeroHedge & YahooFinance

Bankers to Short Sellers: We Don’t Like Your Short Shorts

ABA Urges SEC to Investigate Short Selling of Banking Equities: The American Bankers Association has called on the U.S. Securities and Exchange Commission to investigate the short selling of publicly traded banking equities that it says are disconnected from underlying financial realities.

Short Sellers Profit from Banking Collapse: Short sellers have made significant profits from betting against certain regional banks, with paper profits reaching $378.9 million in a single day (5/4/23), according to a report by analytics firm Ortex.

Rules for Thee, Not for Me: The American Bankers Association has called for clear messages and appropriate enforcement actions against market manipulation and other abusive short selling practices.

SEC Vows to Address Misconduct: SEC Chair Gary Gensler has said the agency will go after any form of misconduct that threatens investors or markets.

AI ART OF THE DAY

Tim Cook (Tim Apple) and PEPE celebrate their wins

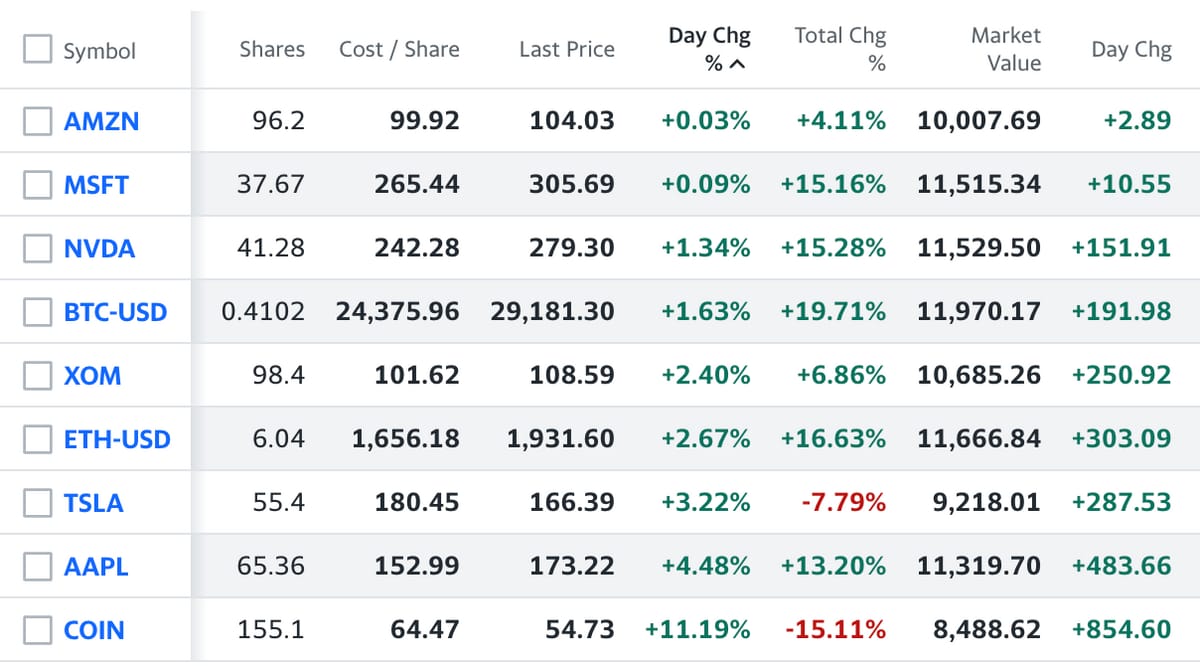

The BRRR’s Portfolio

Keeping our eyes on crypto

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

Fed decisions can be a real pain in the assets. Join our Facebook group for industry insights and tricks to stay ahead of the curve. Memes for days, too.

The BRRR is meant for informational purposes only. It is not meant to serve as investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.