GM, BRRR, and happy Nvidia day.

The 2023 market darling & AI leader will dictate the near-term direction of risk assets with its Q2 earnings report after the bell today. Expectations are quite high:

- Q2 EPS Est.: $2.09 (+305.8% Y/Y)

- Q2 Revenue Est.: $11.08B (+66.1% Y/Y)

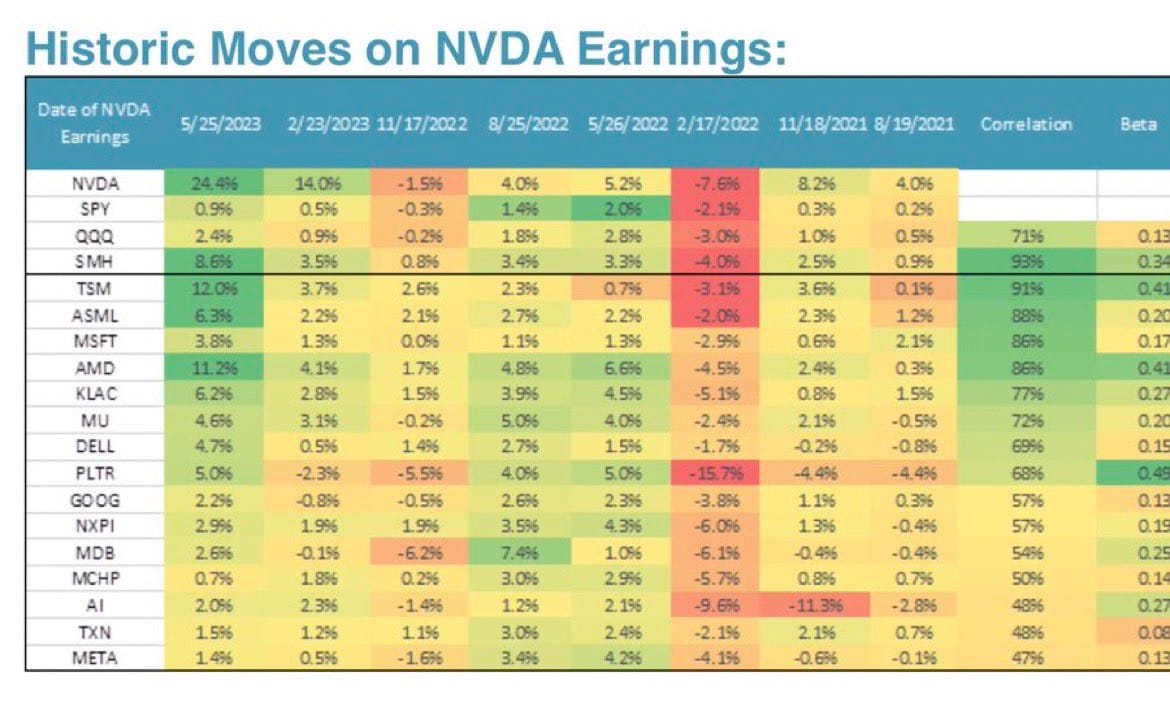

In recent quarters, we’ve seen a large swath of other tech names move with high directional correlation to NVDA, pointing to its bellwether status.

In the chart below, you’ll see that semiconductor names like TSM, ASML, and AMD surged by as much as 12% in tandem with NVDA as it moved 24% in response to its last earnings release.

As alluded to in our email’s headline, options markets are pricing in an 11.2% move in either direction for NVDA today - incredible volatility for a 1.1-trillion-dollar company.

Elsewhere, look for sentiment to leak out of Jackson Hole ahead of Fed Chair Jerome Powell’s annual address on Friday. He’s expected to signal whether the central bank intends to hold rates around current levels for longer than investors anticipate, or if he’s ready to walk rates lower.

No portfolio moves today- but you’ll want to upgrade to our premium tier for $2/month to see the asset we bought on Wednesday with 11% of our portfolio.

Today’s newsletter is brought to you by The Rundown AI. Please consider subscribing and opening their emails - it’ll directly support us at The BRRR. 👇

What Else I’m Reading

The Rundown AI Join 250k+ reading AI news and learning about AI tools every week. The Rundown does an outstanding job surfacing the most important breakthroughs from this powerful technology. Here’s your link to subscribe for free.

Market News

Nvidia Earnings: Will They Smash Again?

Nvidia is expected to beat earnings expectations when it reports results after market close today, driven by growing demand for its GPU chips in data centers and AI applications. The company has established clear dominance in advanced GPUs used for gaming, crypto mining, autonomous vehicles, and AI.

Nvidia shares have tripled in 2023 and has helped propel the S&P 500 (.SPX) to a 14% gain this year. Part of the Magnificent Seven group of megacap stocks, which also include Apple and Microsoft, the group's collective rise was responsible for roughly two-thirds of the S&P 500’s increase through July.

NVDA’s competitive position has allowed it to excel despite the recent downturn in the semiconductor industry. However, high expectations have led to a lofty valuation, so any hints of weakness from Nvidia could result in a significant stock decline.

Business Spending Surge: Capital spending by hyperscale cloud companies has accelerated recently, likely boosting data center revenue for Nvidia's specialized AI chips. This trend could continue as AI moves mainstream.

Competitor Delays: Nvidia's main rival AMD has faced production delays, potentially allowing Nvidia to gain share this quarter at higher prices.

Automotive Upside: Surging demand for electric vehicles requiring AI-powered self-driving capabilities may provide an earnings tailwind.

Leader in Parallel Computing: Nvidia's GPU revenue could top CPU sales at Intel and AMD for the first time, underlining its dominance in massively parallel computing critical for AI.

Generative AI Boost: ChatGPT and Dall-E have sparked intense interest in large language models. Nvidia powers training for these models, driving data center chip sales.

Valuation Risks Remain: Nvidia trades at nearly 50x earnings, so any disappointment could lead to a painful decline. Macro uncertainty persists.

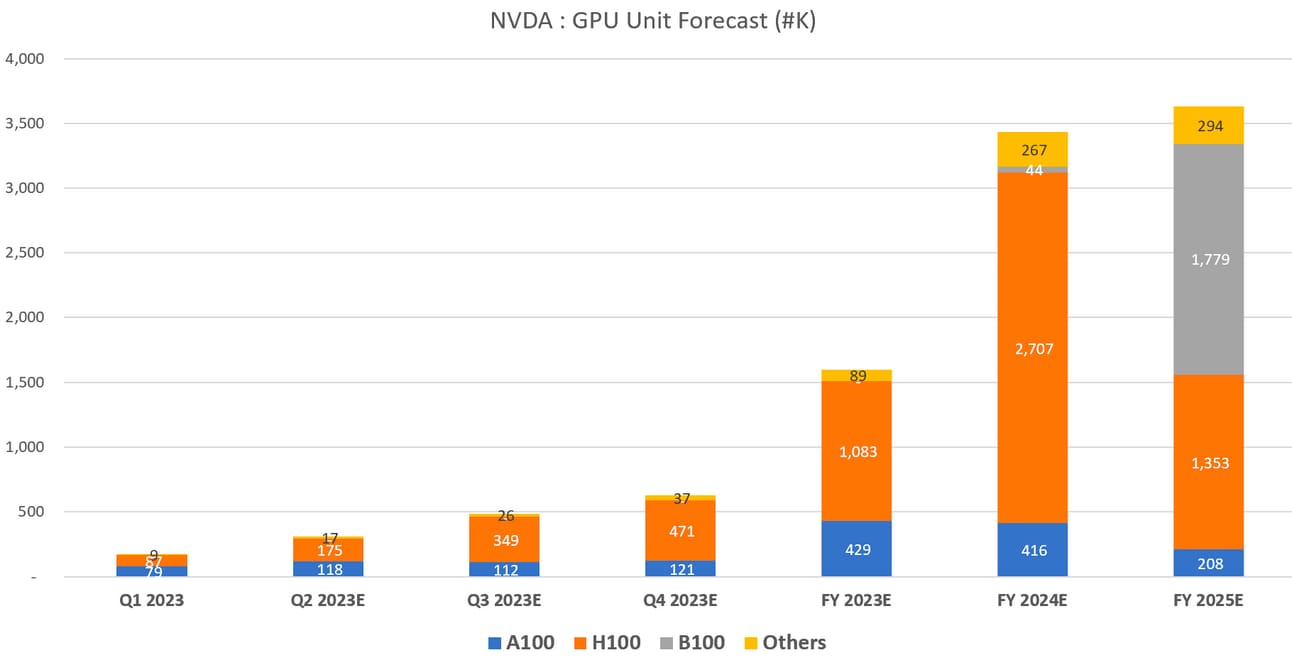

Look at how many GPUs they expect to sell (in thousands)

Macro News

Economic Data: Now Featuring the 'Biden Bounce' (Downwards)

Throughout 2023, there has been a consistent pattern of economic data releases by the Biden administration being revised downwards. This trend has raised suspicions, suggesting that initial figures are inflated to reflect positively on the administration and stimulate market activity, only to be quietly adjusted downwards later.

Recent analysis indicates that there will be additional significant downward revisions to the non-farm payroll (NFP) data, especially for late 2022 and early 2023. Estimates suggest a total downward NFP revision of around 650k from March 2022 to March 2023. Previously, we had covered it’s importance a couple different times.

This revision challenges the narrative of a tight labor market and suggests that policy tightening impacted labor markets earlier than previously thought - which if true, means the Fed may have overtightened.

Significant Downward Revisions: analysis indicates that the NFP data has been overstating job growth. Estimates based on alternate data suggest a downward revision of about 650k for the period from March 2022 through March 2023.

Potential Market Implications: If the anticipated downward jobs revision of almost two-thirds of a million is confirmed, it could have significant market repercussions. The Federal Reserve's stance on future rate hikes might change, potentially strengthening the dovish case.

Today’s Reader Poll

Vote in today’s poll before 4PM: if you’re correct, I’ll give you 1 month of our premium subscription for free.

Where will NVDA's earnings land today?

AI Art of The Day

Premium Subscriber Section

You’ll need to upgrade your subscription to view our portfolio and get our real-time trade alerts. You can upgrade for $2/month or $9.99/year.

Trades, Watchlist & Live Portfolio

(paywall only)

Trades

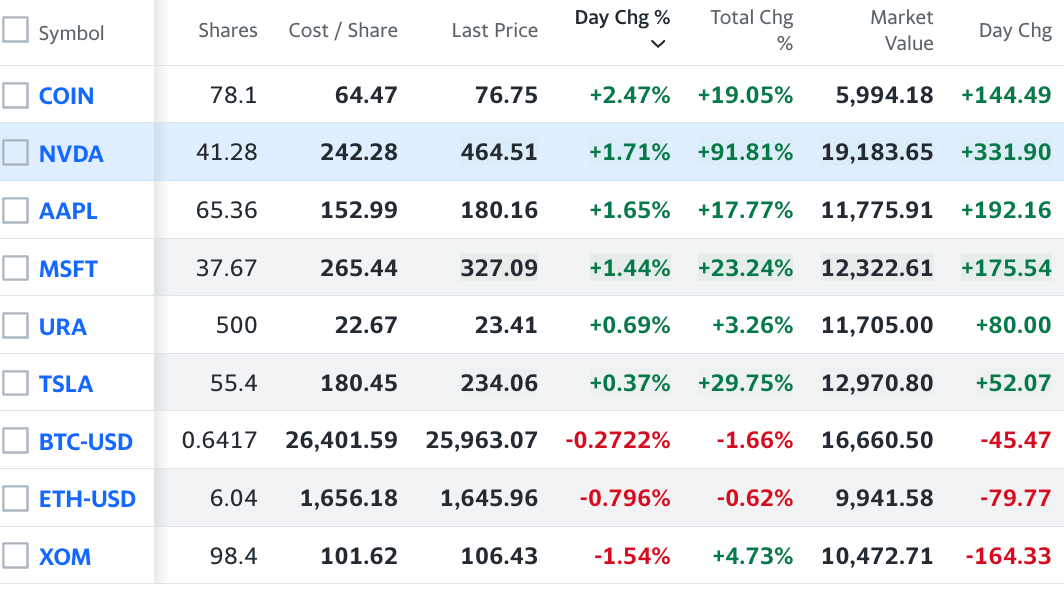

We opened a position in $URA this week - it’s an ETF that tracks the price of Uranium. We’ll publish our longer thesis on the reason on Friday, but as we wrote last week, we believe the Nuclear Energy narrative is gaining steam very quickly.

Monday 8/21/23 9:30 AM: BUY 500 URA @ $22.67

Wednesday 8/16/23 10am: SELL 103.9 $AMZN @ $136.6

Wednesday 8/9/23 9am: BUY 0.2315 $BTC @ $29,990

Watchlist

$META: Sleeper in AI race and ad biz is proving resilient

$PLTR: AI for government intelligence

Portfolio

How was today's email?

Got feedback? Follow the writer on Twitter @frank_locascio and send a message.

The BRRR is meant for informational purposes only. It is not investment advice. Please consult with your investment, tax, or legal advisor before making any investment decisions.